How to Use Forex Correlation

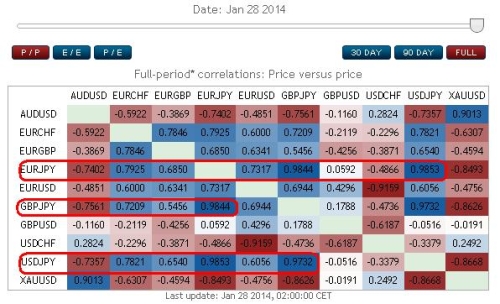

Daily Forex Correlation Table – January 28, 2014

Typically a correlation of -/+ 70 is significant and noteworthy, while -/+ 80 is a strong correlation (or strong inverse correlation if negative). Correlations do not measure magnitude.For example, the USDJPY and GBPJPY have a +98.7 correlation based on the chart below. They usually move in a similar direction,but that does not mean they move the same amount. Based on volatility data (a separate stat shown on the Daily Forex Stats page) the USD/JPY currently moves 72.7 pips while the GBP/JPY moves

137.4 pips per day. This is important when hedging and attempting to control risk, discussed later.

Correlations are constantly changing, usually at a slow pace. The exact numbers used in all these examples are subject to change on a daily basis. Always check for the newest correlation and/or volatility

data. That said, certain pairs generally exhibit strong positive and inverse correlations to each even though the exact amount of correlation fluctuates over time. The statistics on the Daily Forex Stats are updated daily to reflect the forex correlations between pairs. The correlations are presented in a matrix as shown in the table below, and are presented for hourly, daily and weekly

data.

Visit my article and comment:

The Art of Ichimoku