Full report is available here.

Summary

Summary

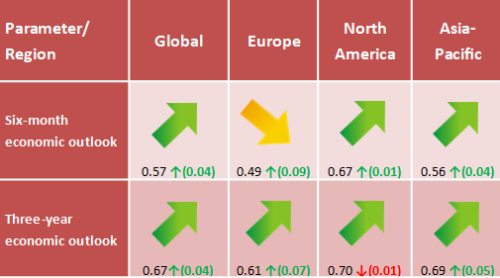

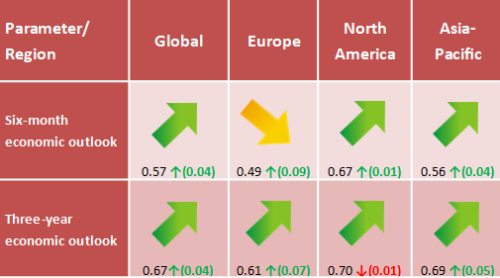

- The global economy showed weak performance over the first quarter of 2016 mainly on the back of a slowdown in emerging markets, while growth in developed markets still remains weak. The major headwinds that were determining the global economic scene last month were developments in the oil market, worries about a downturn in China’s economy and monetary policy decisions from the US, Europe and Japan. Nevertheless, despite the fact that the Fed decided to leave rates on hold in April along with the possibility of ‘Brexit’ and surprising inaction from the Bank of Japan, professors’ sentiment jumped in the observed month.

- Having faced a number of unpleasant economic and political issues, including ‘Brexit’ worries, terrorist attacks in Belgium and high inflow of refugees in March, Euro zone’s economy seems to have picked up a bit of pace in April, as important growth indicators signalled recovery in domestic demand and jobs market in the Q1. However, the still unsolved Greek crisis and rising nationalistic political moods around the bloc do not seem to have shaken economists’ confidence, as both short and long term gauges rose over the measured month.

- With the Federal Reserve maintaining a more cautious stance regarding rate hikes this year and ongoing weakness in the energy market putting a dent in economic activity in the first quarter, North America saw mixed results in April, with the six-month sentiment inching up slightly, while the three-year measure shed 0.01 points.

- The positive sentiment for the Asia-Pacific region does not seem to have been snapped in April, with overall confidence remaining rather positive despite a surprise inaction from the BoJ and persistent uncertainty over the state of Chinese economy.