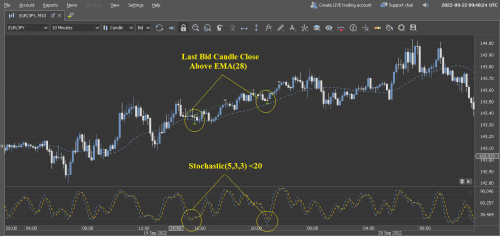

I'm using 2 indicators: EMA and Stochastic. The strategy trade EUR/JPY on 10 minutes time frame with amount trade 6M, slippage 3 pips, stop loss 299 pips, take profit 12 pips.

For EMA, I'm using period = 28 in a 10 minutes time period to know if the instrument is oversold or overbought in shorter time period.

For Stochastic, I'm using fast %K period = 5, slow %K period = 3, slow %K MAType = SMA and slow %D period = 3 in a 10 minutes time period to confirm what trend is going to be in a shorter time period.

Opens sell positions if last bid candle close below EMA, Stochastic Slowd > 80 and last bid candle open is less than last bid candle close.

Opens buy positions if last bid candle close above EMA, Stochastic Slowd < 20 and last bid candle open is greater than last bid candle close

Thanks!

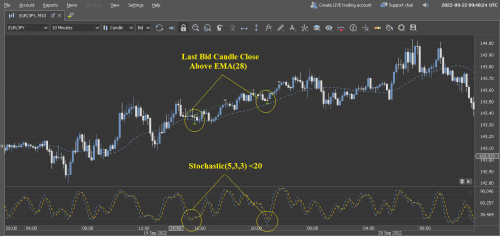

For EMA, I'm using period = 28 in a 10 minutes time period to know if the instrument is oversold or overbought in shorter time period.

For Stochastic, I'm using fast %K period = 5, slow %K period = 3, slow %K MAType = SMA and slow %D period = 3 in a 10 minutes time period to confirm what trend is going to be in a shorter time period.

Opens sell positions if last bid candle close below EMA, Stochastic Slowd > 80 and last bid candle open is less than last bid candle close.

Opens buy positions if last bid candle close above EMA, Stochastic Slowd < 20 and last bid candle open is greater than last bid candle close

Thanks!