Read full report here.

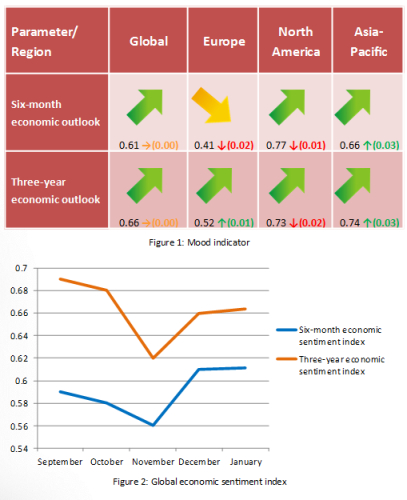

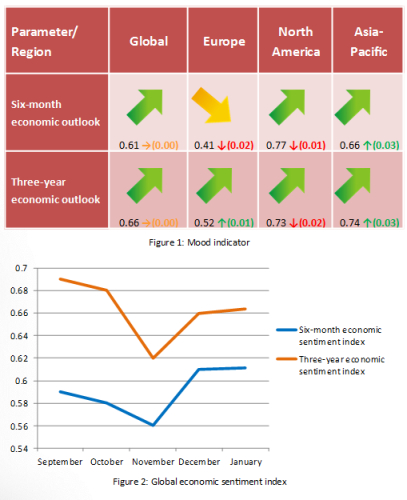

- The beginning of a new year was marked by unexpected decisions and moves from major central banks all around the world, which were triggered by the latest economic data and developments in global financial markets. However, the impact of the unexpected rhetoric of some central banks on short-term and long-term economic sentiment appeared to be limited. Both six-month and three-year global economic sentiment indexes were unchanged in January from the previous month, remaining in the green territory, which indicates improving conditions going forward.

- Europe’s six-month economic sentiment index, which came in at 0.41 in the reported month, pointed to the fact that the number of pessimists outweighed optimists. Thus, in the coming months, recovery in the regions was questioned. However, as ECB decided to deploy full-blow QE programme, the decision might help push the index higher. Experts expected slightly brighter long-term economic prospects, as the corresponding index climbed to 0.52. Yet, professors were likely to remain concerned about the European economic future, as the index hovered just slightly above the 50-mark threshold, which separates pessimism from optimism.

- Apparently concerns over low inflation worldwide, including the world’s number one economy, as well as plunging oil prices, which affected Canada’s economy, weighed on professors’ economic forecasts. Both short and long run sentiment indexes ticked slightly lower in January, but firmly remained in a positive area.

- Asia-Pacific six-month and three-year economic sentiment indexes rebounded in January after four consecutive declines in the previous months. Economic growth in the region remained patchy, with China’s economy, the world’s second biggest, slowing, while still expanding at a solid pace, compared to other countries