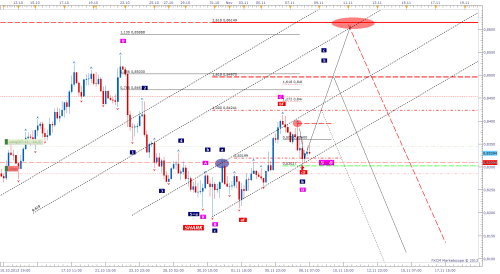

Pair stopped at mentioned level D of potential 5-0 pattern. I consider move down finished as ending diagonal but because of touching a (labeled and marked blue also with ellipse) had to change my previous count; now I thing Zig Zag with Flat as b wave is in play and we ought to be in c wave which should unfold as motive wave either impulse (looking on lower TFs less probable) either ending

diagonal (wedge or 3 drive sell); targets would be c=a @0,8424 (less probable) 162 expansion @0,8497 and last at 262 expansion of wave @0,8615; as most interesting target I find third one because looking at weekly there is 100% target of 5th wave comparing to 1st wave and price action would slightly exceed 113 extension what would form new Shark and potential 5-0 pattern again; about this later, when time comes…

In case that price goes lower and establishes new LL, possible W&R on H4 then are two possibilities: either low of 5th wave of ending diagonal would form either second wave of Flat would bottomed and up move follows in both cases; third option, which I do not like and expect, is that 5 waves c on H4 would develop and then we would go lower..... Further is hard to discuss.

Because of NFP release later today I must take in consideration also 5-0 failure; in this case my count of ending diagonal would be wrong and it would be Zig Zag; if price intends to go lower then I think it should hit at least 50% of move down @0,8360 where several options would come for next move development to downside. Or option which I do not like and expect...

Conclusions:

1. If down into low below 0,8306 first:observe potential W&R development; levels to watch are just below 0,8306

and extensions 113 and 127 and les probable 162%

2. If up: observe behavior at 50% of whole move down @0,8360 and above 0,8395 peak; strong break of these level

leads against targets.

Take care and good trading!

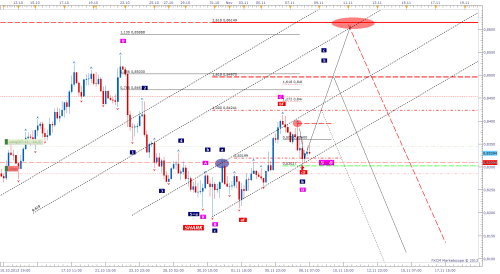

diagonal (wedge or 3 drive sell); targets would be c=a @0,8424 (less probable) 162 expansion @0,8497 and last at 262 expansion of wave @0,8615; as most interesting target I find third one because looking at weekly there is 100% target of 5th wave comparing to 1st wave and price action would slightly exceed 113 extension what would form new Shark and potential 5-0 pattern again; about this later, when time comes…

In case that price goes lower and establishes new LL, possible W&R on H4 then are two possibilities: either low of 5th wave of ending diagonal would form either second wave of Flat would bottomed and up move follows in both cases; third option, which I do not like and expect, is that 5 waves c on H4 would develop and then we would go lower..... Further is hard to discuss.

Because of NFP release later today I must take in consideration also 5-0 failure; in this case my count of ending diagonal would be wrong and it would be Zig Zag; if price intends to go lower then I think it should hit at least 50% of move down @0,8360 where several options would come for next move development to downside. Or option which I do not like and expect...

Conclusions:

1. If down into low below 0,8306 first:observe potential W&R development; levels to watch are just below 0,8306

and extensions 113 and 127 and les probable 162%

2. If up: observe behavior at 50% of whole move down @0,8360 and above 0,8395 peak; strong break of these level

leads against targets.

Take care and good trading!