- US Dollar produces mixed reaction, with the DXY Index trading lower ahead of newly-minted Fed Chair Jerome Powell’s first press conference.

See our longer-term forecasts for the US Dollar, Euro, British Pound, and other major currencies with the DailyFX Trading Guides.

The Federal Open Market Committee did what was widely expected of them today when they announced a 25-bps hike to the main overnight benchmark rate into a range of 1.50-1.75%, as was priced into the market well in advance of today’s policy meeting. The trifecta of improved growth prospects, stable inflation expectations around the medium-term target of +2%, and consistent strength in the labor market made it an easy decision for the FOMC at the first meeting helmed by Jerome Powell.

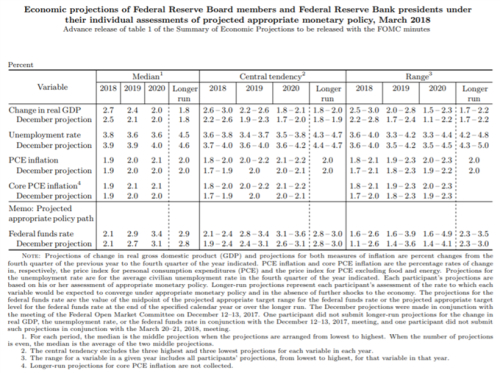

Looking at the summary of economic projections (SEP) and ‘dot plot,’ commentary from the initial FOMC statement suggests that policymakers are more optimistic on the US economy. Policymakers expect “Inflation on a 12‑month basis is expected to move up in coming months and to stabilize around the Committee’s 2 percent objective over the medium term.”

It would appear that inflation could also undercut the Fed’s best laid plans to raise rates two more times this year: “Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.”

Overall, the FOMC saw the median Fed funds rate at 2.1% at the end of 2018, as they have at the past five FOMC meetings. Likewise, they saw the median Fed funds rate at 2.9% at the end of 2019, up from 2.7% in December 2017. Finally, the median Fed funds rate for the end of 2020 was revised up to 3.4% from 3.1%.

In sum, today’s statement can be seen as slightly hawkish than what markets were pricing in ahead of time, given the outlook for two more hikes this year and three for 2019. However, given the balance of risks, the initial decision appears to be a wash for the US Dollar – neither good nor bad.

Here are the Fed’s new forecasts:

See our longer-term forecasts for the US Dollar, Euro, British Pound, and other major currencies with the DailyFX Trading Guides.

The Federal Open Market Committee did what was widely expected of them today when they announced a 25-bps hike to the main overnight benchmark rate into a range of 1.50-1.75%, as was priced into the market well in advance of today’s policy meeting. The trifecta of improved growth prospects, stable inflation expectations around the medium-term target of +2%, and consistent strength in the labor market made it an easy decision for the FOMC at the first meeting helmed by Jerome Powell.

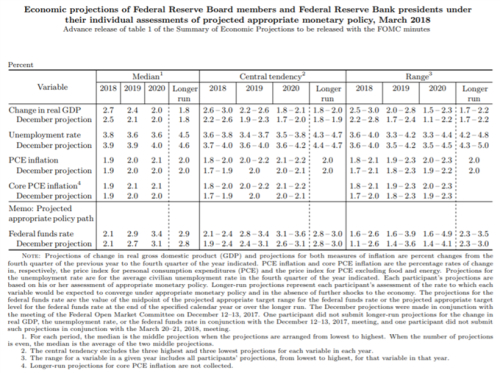

Looking at the summary of economic projections (SEP) and ‘dot plot,’ commentary from the initial FOMC statement suggests that policymakers are more optimistic on the US economy. Policymakers expect “Inflation on a 12‑month basis is expected to move up in coming months and to stabilize around the Committee’s 2 percent objective over the medium term.”

It would appear that inflation could also undercut the Fed’s best laid plans to raise rates two more times this year: “Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.”

Overall, the FOMC saw the median Fed funds rate at 2.1% at the end of 2018, as they have at the past five FOMC meetings. Likewise, they saw the median Fed funds rate at 2.9% at the end of 2019, up from 2.7% in December 2017. Finally, the median Fed funds rate for the end of 2020 was revised up to 3.4% from 3.1%.

In sum, today’s statement can be seen as slightly hawkish than what markets were pricing in ahead of time, given the outlook for two more hikes this year and three for 2019. However, given the balance of risks, the initial decision appears to be a wash for the US Dollar – neither good nor bad.

Here are the Fed’s new forecasts: