All profitable trading systems or strategies can be divided into 2 groups - those that work well in consolidation and those that work well in trends. This is due to the type of indicators/tools which they used. Systems that use overbought/oversold indicators (momentum, oscillators) works well in the consolidation, while in trends all those systems that use indicators/tools that confirm the trend (e.g. averages lines).

It would seem that the easiest way to remove disadvantagies of any system it would be putting together these indicators, but simple combination of them does not give good results, and this is due not only to the differences in the structure of these indicators but also therefore that signals to open positions generated by averages are delayed in relation to signals generated by the overbought/oversold indicators. On the other hand, it is known that the market/price is in a trend or in consolidation alternately and we do not know duration of these phases. So, how to build an optimal automatic strategy that will bring profits to trader in the long period? The answer is in statistics and money management.

CarnivalJanuary2020 strategy is simple and works on EURUSD pair. It uses the popular Stochastic indicator, so it generates signals to open position based only on overbought or oversold market. I chose this indicator because it is intuitive and therefore easy to use.

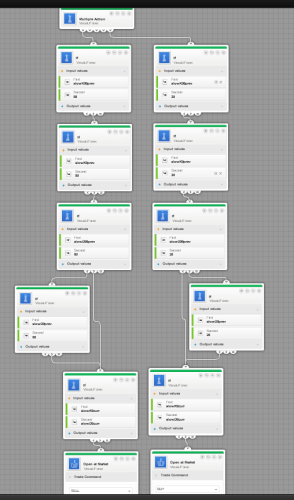

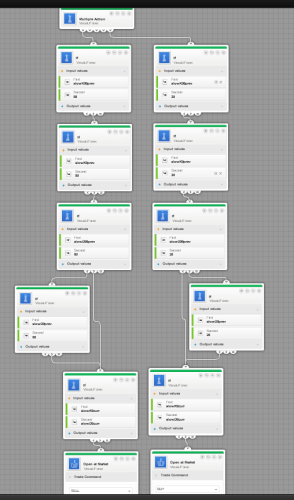

The strategy uses this indicator with 3 different parameters configurations like 3 different indicators - for the 5M period Stoch(9,3SMA,3SMA) and Stoch(96,8SMA,3SMA) and for the 1H period Stoch(288,12SMA,3SMA). Stoch 1Hperiod is used only for close position.

For open position only both Stoch 5M period are used and this is a fixed scheme for all versions of the strategy.

In all versions of the strategy trade amount is 5L, slippage is 1 pip. Differences among versions concern the size of SL, if TP exists or not, if TS works or does not work, conditions of Stoch for close position were changed once.

In July Strategy Contest versions 5. and 6. of the strategy were working. The difference between them concerns only TS – in version 5. TS does not work, in version 6. TS works. Except TS, conditions for closing position are the same in both versions. Conditions for close positions:

In these versions SL=31 pips. Instead of fixed TP=92pips for closing position I used condition which allows close position when Stochastic reaches overbought/oversold level and at the same time ProfitLossInPips is equal or higher than 92pips. This gives higher profits in comparison with situation when TP is fixed.

SL=31 and TP>=92 causes that R:R ratio is potentially very good. Applying of 1H Stoch indicator allowed to increase potential profit from each profitable transaction in comparison with simple closing position when Stoch 5M shows overbought/oversold market.

These solutions allowed to gain good result by the strategy in July in spite of low number of profitable trades in relation to all trades. Part of unprofitable trades was caused by disadvantage of Stochastic. I mean the situation when Stochastic all the time shows overbought market and price is going up and up for a long time, without any correction. This is chart from August Contest, version 6. works

One more thing is interesting – this change of the strategy version (from 5. to 6.) during July negatively affected on results achieved in July. Backtests show that version 5. used throughout July gives a better result than I achieved in the July Contest. The same is true for version 6. This situation may confirm that applying the same rules in a given period is important for the results achieved by a trader, because each strategy has its own “melody”.

It would seem that the easiest way to remove disadvantagies of any system it would be putting together these indicators, but simple combination of them does not give good results, and this is due not only to the differences in the structure of these indicators but also therefore that signals to open positions generated by averages are delayed in relation to signals generated by the overbought/oversold indicators. On the other hand, it is known that the market/price is in a trend or in consolidation alternately and we do not know duration of these phases. So, how to build an optimal automatic strategy that will bring profits to trader in the long period? The answer is in statistics and money management.

CarnivalJanuary2020 strategy is simple and works on EURUSD pair. It uses the popular Stochastic indicator, so it generates signals to open position based only on overbought or oversold market. I chose this indicator because it is intuitive and therefore easy to use.

The strategy uses this indicator with 3 different parameters configurations like 3 different indicators - for the 5M period Stoch(9,3SMA,3SMA) and Stoch(96,8SMA,3SMA) and for the 1H period Stoch(288,12SMA,3SMA). Stoch 1Hperiod is used only for close position.

For open position only both Stoch 5M period are used and this is a fixed scheme for all versions of the strategy.

In all versions of the strategy trade amount is 5L, slippage is 1 pip. Differences among versions concern the size of SL, if TP exists or not, if TS works or does not work, conditions of Stoch for close position were changed once.

In July Strategy Contest versions 5. and 6. of the strategy were working. The difference between them concerns only TS – in version 5. TS does not work, in version 6. TS works. Except TS, conditions for closing position are the same in both versions. Conditions for close positions:

In these versions SL=31 pips. Instead of fixed TP=92pips for closing position I used condition which allows close position when Stochastic reaches overbought/oversold level and at the same time ProfitLossInPips is equal or higher than 92pips. This gives higher profits in comparison with situation when TP is fixed.

SL=31 and TP>=92 causes that R:R ratio is potentially very good. Applying of 1H Stoch indicator allowed to increase potential profit from each profitable transaction in comparison with simple closing position when Stoch 5M shows overbought/oversold market.

These solutions allowed to gain good result by the strategy in July in spite of low number of profitable trades in relation to all trades. Part of unprofitable trades was caused by disadvantage of Stochastic. I mean the situation when Stochastic all the time shows overbought market and price is going up and up for a long time, without any correction. This is chart from August Contest, version 6. works

One more thing is interesting – this change of the strategy version (from 5. to 6.) during July negatively affected on results achieved in July. Backtests show that version 5. used throughout July gives a better result than I achieved in the July Contest. The same is true for version 6. This situation may confirm that applying the same rules in a given period is important for the results achieved by a trader, because each strategy has its own “melody”.