We are at an important inflection point this morning and it's time to strike the iron as it's hot hot hot! I'm running a bit late today so I only have time to report on equities - but it's a very good one, so pay attention:

This is what's working in our favor right now - the GBP/JPY is still looking divergent or at least unsupportive. Could change quickly but there are no guarantees in the trading game. So let's look at the price action on the futures side:

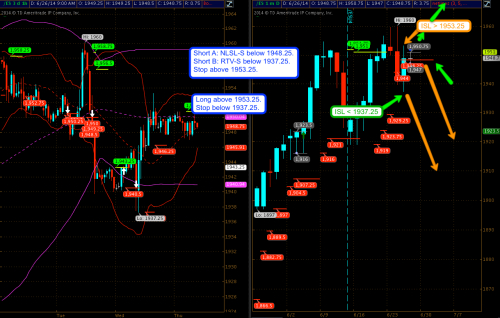

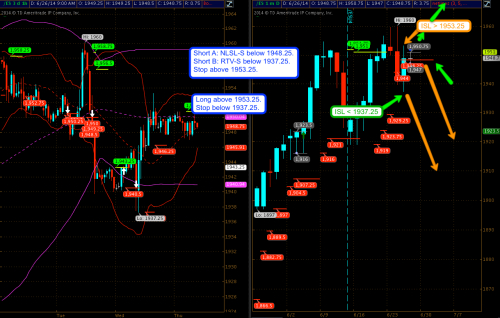

This is a textbook RTV-S configuration and you can play it by the rules. My discretionary style however differs a bit from Ivan and Scott which is why I use Net-Lines as additional price inflection points. Sometimes they afford me better entries near important price congestion clusters. In this case we have a typical 1-2 pattern here (if you allow me a tiny bit of wave wanking). What comes next will of course determine where prices head next. I personally have no bone in this fight (yet), so I'm able to objectively assess all entry possibilities that the tape is affording me right now. Here we go:

It's not too late - learn how to consistently bank coin without news, drama, and all the misinformation. If you are interested in becoming a subscriber then don't waste time and sign up here. The Zero indicator service also offers access to all Gold posts, so you actually get double the bang for your buck.

This is what's working in our favor right now - the GBP/JPY is still looking divergent or at least unsupportive. Could change quickly but there are no guarantees in the trading game. So let's look at the price action on the futures side:

This is a textbook RTV-S configuration and you can play it by the rules. My discretionary style however differs a bit from Ivan and Scott which is why I use Net-Lines as additional price inflection points. Sometimes they afford me better entries near important price congestion clusters. In this case we have a typical 1-2 pattern here (if you allow me a tiny bit of wave wanking). What comes next will of course determine where prices head next. I personally have no bone in this fight (yet), so I'm able to objectively assess all entry possibilities that the tape is affording me right now. Here we go:

- Short via the NLSL below 1948.25 - put your stop above a few ticks above yesterday's highs (1953.25).

- Short via the regular RTV-S entry point one tick below (or at if you want) 1937.25. Your ISL will again be above 1953.25. This will result in a smaller position size as you are affording yourself a larger stop. When in doubt use our handy futures risk calculator.

- Long above the NLSL or yesterday's highs. My stop would be below 1937.25.

It's not too late - learn how to consistently bank coin without news, drama, and all the misinformation. If you are interested in becoming a subscriber then don't waste time and sign up here. The Zero indicator service also offers access to all Gold posts, so you actually get double the bang for your buck.