Full report available here.

Summary

Summary

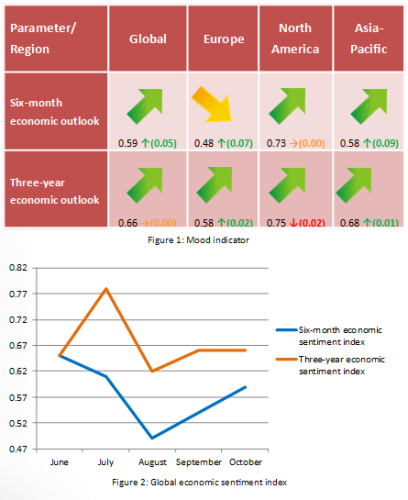

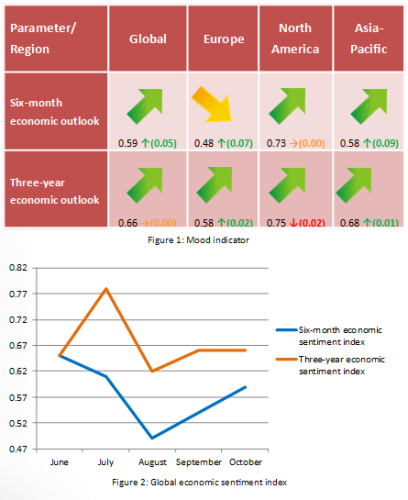

- The sentiment of professors continued to recover going into the final quarter of the year after a precipitous fall in August when China’s equity market crashed, causing a spillover effect across the globe. Nevertheless, slowing growth in emerging economies, particularly in China, remains a topical issue on the agenda of economists and central bankers.

- Even though academia experts short-term outlook for Europe’s economy improved strongly, the gauge remained in negative territory for six months in a row, indicating pessimism continued to prevail. The reading came after official data showed a negative growth in consumer prices in the Euro region, suggesting ECB stimulus measures have yet to bring desired results. The three-year outlook remained firmly in green zone, as the ECB reassured that it stood ready to deploy extra stimulus package to support the economy.

- The six-month sentiment index for North America remained unchanged in October, whereas the long-term gauge declined slightly by 0.02 points. Professors' mood appeared to be unaffected by the Fed’s decision to keep rates on hold at the long-anticipated September meeting.

- Despite ongoing concerns over economic health of developing countries, the six-month outlook for Asia-Pacific surged in October, while the reading which tracks professors confidence in the region’s prospects in the three years from now edged up modestly.