Hello Traders,

We all know that making informed decisions with a solid game plan is necessary to be successful in trading. In this blog I will share my outlook and the rules I follow to make informed trades related to Forex, Commodities, and Equities. Yes, I know that Dukascopy is primarily focused on Forex but in my opinion the other markets have an huge effect on Forex as well.

So my friends I hope you enough my blog, and feel free to add a comment or friend request. All are welcome. As always remember your "Money Matters" so make informed trading decisions.

News

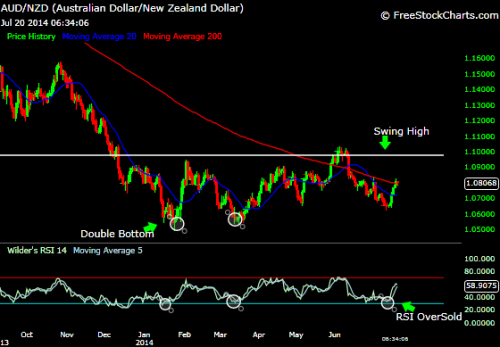

The Australian dollar AUD/NZD is poised to climb to the highest level since November against its New Zealand peer, after rising above a key level of resistance for the first time in more than a year.

The Aussie may strengthen from a possible double bottom pattern, after a “bullish break” above the 200-day moving average said Shyam Devani, a Singapore-based senior technical strategist at Citigroup Inc., the world’s biggest foreign-exchange trader. It was the first time the exchange rate had exceeded the gauge since March 2013.

The Aussie has rallied for three months against the kiwi, the longest streak since 2011, after reaching a lows in March 2014. That formed the second part of the double bottom, which began with a more than eight-year low in January.

Hedge funds and other large speculators turned bullish on the Australian dollar for the first time in almost a year. The difference in the number of wagers on a rise compared with those on a decline -- so-called net longs -- swung to as high as 19,462 in the week ended May 20, figures from the Washington-based Commodity Futures Trading Commission show, from net shorts of 65,723 contracts in January.

Bias: Bullish (See chart below)

With the RSI supporting an over sold & bottoming signals, and the 200 SMA being breached for the 2nd time, we are looking for the swing high to be taken out and a continued bullish sentiment. In the short time there might be some continued sideways and ranging price movement until the swing high is broken.

As always traders remember "Money Matters" so make informed trading decisions.

Jay Trader

We all know that making informed decisions with a solid game plan is necessary to be successful in trading. In this blog I will share my outlook and the rules I follow to make informed trades related to Forex, Commodities, and Equities. Yes, I know that Dukascopy is primarily focused on Forex but in my opinion the other markets have an huge effect on Forex as well.

So my friends I hope you enough my blog, and feel free to add a comment or friend request. All are welcome. As always remember your "Money Matters" so make informed trading decisions.

News

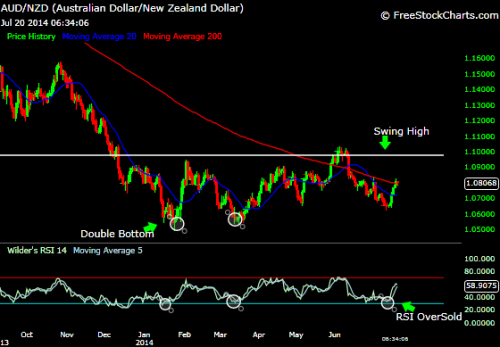

The Australian dollar AUD/NZD is poised to climb to the highest level since November against its New Zealand peer, after rising above a key level of resistance for the first time in more than a year.

The Aussie may strengthen from a possible double bottom pattern, after a “bullish break” above the 200-day moving average said Shyam Devani, a Singapore-based senior technical strategist at Citigroup Inc., the world’s biggest foreign-exchange trader. It was the first time the exchange rate had exceeded the gauge since March 2013.

The Aussie has rallied for three months against the kiwi, the longest streak since 2011, after reaching a lows in March 2014. That formed the second part of the double bottom, which began with a more than eight-year low in January.

Hedge funds and other large speculators turned bullish on the Australian dollar for the first time in almost a year. The difference in the number of wagers on a rise compared with those on a decline -- so-called net longs -- swung to as high as 19,462 in the week ended May 20, figures from the Washington-based Commodity Futures Trading Commission show, from net shorts of 65,723 contracts in January.

Bias: Bullish (See chart below)

With the RSI supporting an over sold & bottoming signals, and the 200 SMA being breached for the 2nd time, we are looking for the swing high to be taken out and a continued bullish sentiment. In the short time there might be some continued sideways and ranging price movement until the swing high is broken.

As always traders remember "Money Matters" so make informed trading decisions.

Jay Trader