Introduction

The strategy was ‘prophetically’ named Breakout_year_2019_Jan and has been a winning strategy ever since.

The strategy was based on 2 currency pairs, the EURUSD and the USDJPY in a 1 hour time frame. The pairs were chosen because of the relatively low bid-ask spread and high liquidity which results in low slippage. The hourly time frame was chosen to have some stable results after eliminating most of the market noise.

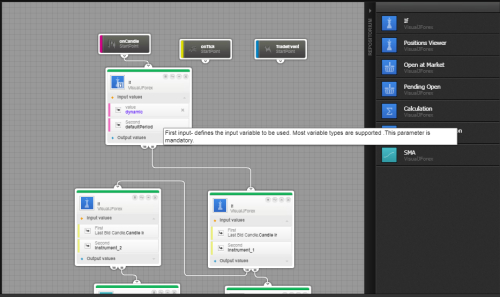

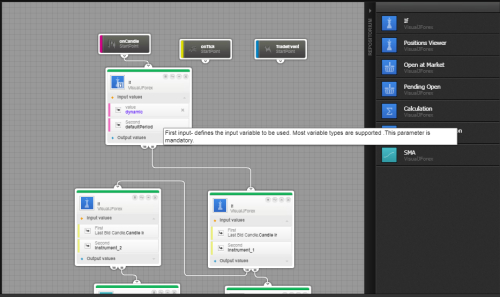

Fig 1

Fig 1

In fig 1, above the default period was 1 hour as earlier alluded to, and Instrument_1 was the EURUSD and Instrument_2 was USDJPY

Buy Strategy

For a buy to be consummated the following conditions need to be fulfilled.

ú CCI should be less than or equal to -100,

ú MACD should be greater than 0

ú Stochastic (5,3,3), slow D% should be less than or equal to 25.

When these conditions are met on an hourly time frame, a Buy order is placed at market for a maximum order size of 15 million and a maximum allowable slippage of 5. The Take profit level will be set at 8 pips from entry and stop loss at 35 pips away.

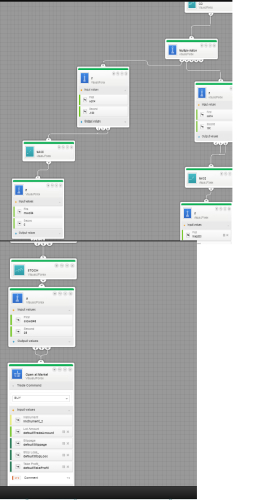

Fig 2

Fig 2

Fig 2 above shows how the Buys side strategy would look like.

Sell Strategy

For a sell to be consummated the following conditions need to be fulfilled.

ú CCI should be greater than or equal to 100,

ú MACD should be less than 0

ú Stochastic (5,3,3), slow D% should be greater than or equal to 25.

When these conditions are met on an hourly time frame, a Sell order is placed at market for a maximum order size of 15 million and a maximum allowable slippage of 5. The Take profit level will be set at 8 pips from entry and stop loss at 35 pips away.

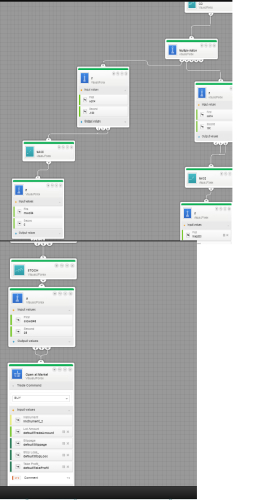

Fig 2

Fig 2

Fig 2 shows how the sell strategy would flow.

Conclusion

The strategy will need to continuously be reviewed so that it will deliver consistent results. Improvement in the risk-reward ratio is another aspect to look at. The strategy can also incorporate other currencies in future.

The strategy was ‘prophetically’ named Breakout_year_2019_Jan and has been a winning strategy ever since.

The strategy was based on 2 currency pairs, the EURUSD and the USDJPY in a 1 hour time frame. The pairs were chosen because of the relatively low bid-ask spread and high liquidity which results in low slippage. The hourly time frame was chosen to have some stable results after eliminating most of the market noise.

Fig 1

Fig 1In fig 1, above the default period was 1 hour as earlier alluded to, and Instrument_1 was the EURUSD and Instrument_2 was USDJPY

Buy Strategy

For a buy to be consummated the following conditions need to be fulfilled.

ú CCI should be less than or equal to -100,

ú MACD should be greater than 0

ú Stochastic (5,3,3), slow D% should be less than or equal to 25.

When these conditions are met on an hourly time frame, a Buy order is placed at market for a maximum order size of 15 million and a maximum allowable slippage of 5. The Take profit level will be set at 8 pips from entry and stop loss at 35 pips away.

Fig 2

Fig 2 Fig 2 above shows how the Buys side strategy would look like.

Sell Strategy

For a sell to be consummated the following conditions need to be fulfilled.

ú CCI should be greater than or equal to 100,

ú MACD should be less than 0

ú Stochastic (5,3,3), slow D% should be greater than or equal to 25.

When these conditions are met on an hourly time frame, a Sell order is placed at market for a maximum order size of 15 million and a maximum allowable slippage of 5. The Take profit level will be set at 8 pips from entry and stop loss at 35 pips away.

Fig 2

Fig 2Fig 2 shows how the sell strategy would flow.

Conclusion

The strategy will need to continuously be reviewed so that it will deliver consistent results. Improvement in the risk-reward ratio is another aspect to look at. The strategy can also incorporate other currencies in future.