Full report

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Along with decline in sentiment indexes, long-term growth prospects appeared to be significantly lower than a month earlier. Especially academia experts were pessimistic over Asia-Pacific region, where GDP is expected to drop in the coming six months towards 2.93% down from 3.80% in June, and plummet to 2.87% by 2017 compared to 4.13% in May. The main reason behind such a dramatic fall in the expected growth rate is geopolitical tensions in the Middle East and Ukraine, which weigh on experts’ sentiment.

In the meantime, the U.S. growth rate is seen to remain unchanged at 1.60% in the short and long term. This is amid the fact that the labour market continues strengthening, with the jobless rate falling to 6.1%, while QE is expected to be completely winded down by October 2014 and interest rate hike is projected to occur sooner than previously thought. All this economic data adds to evidence that the world’s number one economy is gaining steam.

Europe’s GDP is seen growing at 0.83% during six months from now, up from 0.33% in June. An increase in expected GDP may be attributed to the ECB actions, which might provide some boost to the region’s economy. In the long term the Euro economy projected to expand at 0.90% rate.

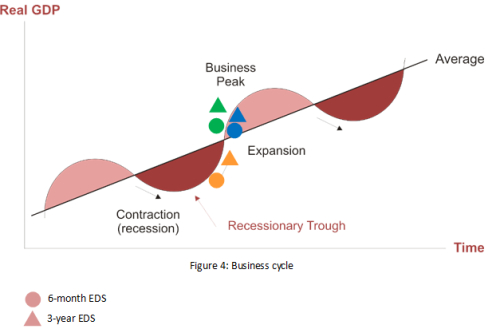

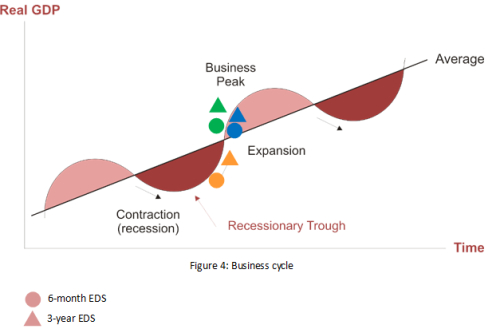

Proportion of those, who see the European economy in the recessionary trough in the short-term rises in July to 15 from 10 seen last month. However, in the long term more and more professors expect the economy to reach the expansion phase. Even though, the number of experts, who foresee the economy expanding in the foreseeable future, increases, still no one expects business peak to be reached within next three years.

As to the North America, it appears that professors have not changed their opinion as to how the economy will evolve in the years to come. Nevertheless, the number of those surveyed, who project the economy to slip to the contraction area, rises to 5, up from 1 a month earlier.

Meanwhile, the Asia-Pacific region is seen to continue its steady path towards the business peak phase, even though the number of professors that expect the economy to reach this level, declines from 6 to 2 in July.

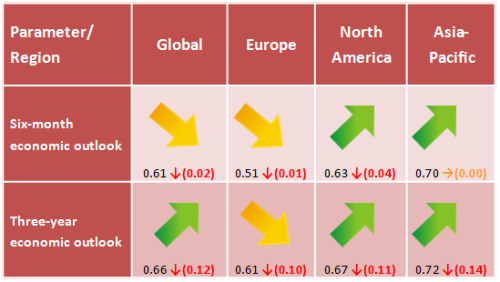

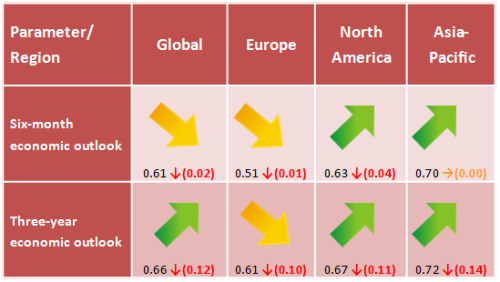

- July Dukascopy Bank Sentiment Index findings appeared to be the most pessimistic. The report revealed that while short-term global economic sentiment index fell moderately, three-year index plummeted by 0.12 points, the biggest decline since records began. This sharp fall may be attributed to geopolitical tensions in the Middle East and Ukraine, as well as uneven economic picture in the world. On top of that, all the regions also posted falls in their both short and long term economic outlook.

- Europe saw both indexes dropping in July, with three-year economic outlook falling at the fastest pace since February 2013. This might be due to the fact that on 5 June the ECB launched unprecedented stimulus, by bringing deposit rate to the negative territory. Unfortunately, stimulus have not brought desired results yet, as fundamentals are still weak in the Euro bloc while economists lose faith in the ECB, as central bank is running out of tools, hence, any additional easing will be highly unlikely even in case of further deteriorating fundamentals.

- While North America posted a slight decline in six-month outlook, index, measuring economic prospects of the region within next three years, slumped by 0.11, the sharpest fall on record.

- Asia-Pacific was the only region, which saw no change in the short-term sentiment. Nevertheless, a 0.14 point fall in three-year economic outlook was the most dramatic decline from the record-high level seen last month.

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against the GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.Along with decline in sentiment indexes, long-term growth prospects appeared to be significantly lower than a month earlier. Especially academia experts were pessimistic over Asia-Pacific region, where GDP is expected to drop in the coming six months towards 2.93% down from 3.80% in June, and plummet to 2.87% by 2017 compared to 4.13% in May. The main reason behind such a dramatic fall in the expected growth rate is geopolitical tensions in the Middle East and Ukraine, which weigh on experts’ sentiment.

In the meantime, the U.S. growth rate is seen to remain unchanged at 1.60% in the short and long term. This is amid the fact that the labour market continues strengthening, with the jobless rate falling to 6.1%, while QE is expected to be completely winded down by October 2014 and interest rate hike is projected to occur sooner than previously thought. All this economic data adds to evidence that the world’s number one economy is gaining steam.

Europe’s GDP is seen growing at 0.83% during six months from now, up from 0.33% in June. An increase in expected GDP may be attributed to the ECB actions, which might provide some boost to the region’s economy. In the long term the Euro economy projected to expand at 0.90% rate.

Proportion of those, who see the European economy in the recessionary trough in the short-term rises in July to 15 from 10 seen last month. However, in the long term more and more professors expect the economy to reach the expansion phase. Even though, the number of experts, who foresee the economy expanding in the foreseeable future, increases, still no one expects business peak to be reached within next three years.

As to the North America, it appears that professors have not changed their opinion as to how the economy will evolve in the years to come. Nevertheless, the number of those surveyed, who project the economy to slip to the contraction area, rises to 5, up from 1 a month earlier.

Meanwhile, the Asia-Pacific region is seen to continue its steady path towards the business peak phase, even though the number of professors that expect the economy to reach this level, declines from 6 to 2 in July.