Read full report here.

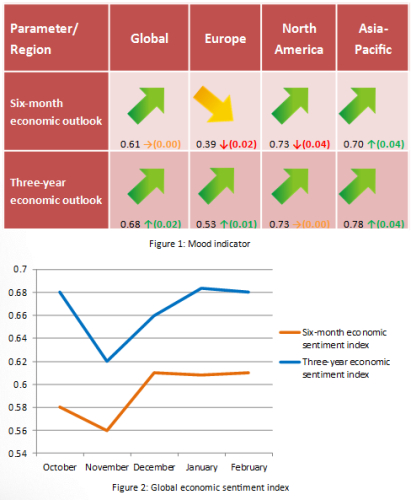

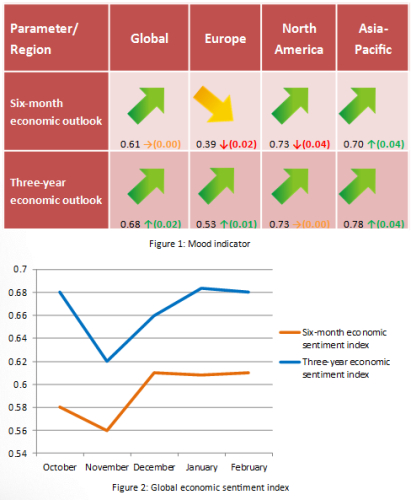

- Although February is the shortest month of the year, it was full of economics and politics related news from all over the world. Given such a slew of data, it barely had a significant impact on global short and long term economic outlook of academia experts. Dukascopy Sentiment Index, measuring global economic prospects during the next six months, remained unchanged from January, while the three-year economic sentiment index rose slightly by 0.02 points to 0.68.

- Tepid economic growth in the Euro zone, slowing pace of expansion in the UK, disinflation concerns as well as difficult negotiation between Eurogroup and Greece over the country’s bailout programme further dimmed experts’ mood. Thus, short-term economic sentiment index edged lower to 0.39, moving further away from the 50-mark threshold, which separates optimism from pessimism. However, professors appeared to be more upbeat about the region’s economic future in three years from now than in January.

- While Canada is being hit by falling commodities prices, US growth has been undermined by slowdown elsewhere, as it weighs on demand for US-made products. Besides, threat of falling inflation is also chasing the region, which is also affecting the Fed’s decision on the timing of the first rate hike. Thus, the short term index retreated to 0.73 from January, while the three-year gauge remained intact.

- There also a number of significant headwinds in Asia Pacific, including slowing growth, falling inflation; still, both six-month and three-year economic sentiment indexes rose in February. This indicates professors anticipated better economic conditions in the region in the foreseeable future.