Full report is available here.

Summary

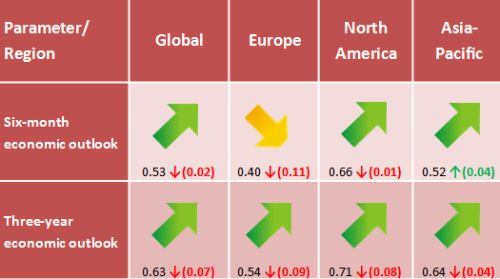

The global economy seems to have stabilized in the previous month, following a turbulent ride in the beginning of the year. The overall economic sentiment was mainly boosted by renewed optimism over the state of Chinese economy along with higher oil prices, which were, in turn, bolstered by expectations that the world’s major producers could come to an agreement to freeze crude oil extraction. Despite that, the persistent economic uncertainty and recent political tensions, namely, the possibility of ‘Brexit’ and approaching elections in many countries, including the US, played a decisive role in determining professors’ sentiment in March, seeing both gauges sliding in the observed month.

Facing a number of threatening economic and political issues, including ‘Brexit’ fears, an extremely high refugee inflow as well as the recent terrorist attacks in Belgium, the confidence in the Euro bloc’s performance has shaken over the measured month, with six-month outlook sliding 0.11 points, while the three-year sentiment plummeted 0.09 points in the measured month.

With the Federal Reserve maintaining a more cautious stance regarding lifting rates in the coming months, North America saw disappointing results in March, as the six-month sentiment index inched down slightly, while the three-year measure shed 0.08 points.

The positive sentiment for the Asia-Pacific region based on rising demand in China seems to have continued in March, as the short-term gauge soared 0.04 points in the observed month. However, with growing skepticism about the ability of Abenomics to rekindle Japan’s economy, market participants’ risk appetite, business and consumer confidence was somewhat dampened in the long term.

Summary

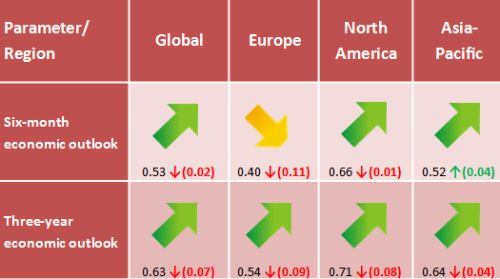

The global economy seems to have stabilized in the previous month, following a turbulent ride in the beginning of the year. The overall economic sentiment was mainly boosted by renewed optimism over the state of Chinese economy along with higher oil prices, which were, in turn, bolstered by expectations that the world’s major producers could come to an agreement to freeze crude oil extraction. Despite that, the persistent economic uncertainty and recent political tensions, namely, the possibility of ‘Brexit’ and approaching elections in many countries, including the US, played a decisive role in determining professors’ sentiment in March, seeing both gauges sliding in the observed month.

Facing a number of threatening economic and political issues, including ‘Brexit’ fears, an extremely high refugee inflow as well as the recent terrorist attacks in Belgium, the confidence in the Euro bloc’s performance has shaken over the measured month, with six-month outlook sliding 0.11 points, while the three-year sentiment plummeted 0.09 points in the measured month.

With the Federal Reserve maintaining a more cautious stance regarding lifting rates in the coming months, North America saw disappointing results in March, as the six-month sentiment index inched down slightly, while the three-year measure shed 0.08 points.

The positive sentiment for the Asia-Pacific region based on rising demand in China seems to have continued in March, as the short-term gauge soared 0.04 points in the observed month. However, with growing skepticism about the ability of Abenomics to rekindle Japan’s economy, market participants’ risk appetite, business and consumer confidence was somewhat dampened in the long term.