In the previous article I described some general principles behind the strategy that I'm currently using in the contest. I encourage you to read it, because the information in it is relevant to this article, in which I will describe a simple process that can be used to improve the strategy, in terms of its entry signal.

To recap, the basic properties of the strategy are:

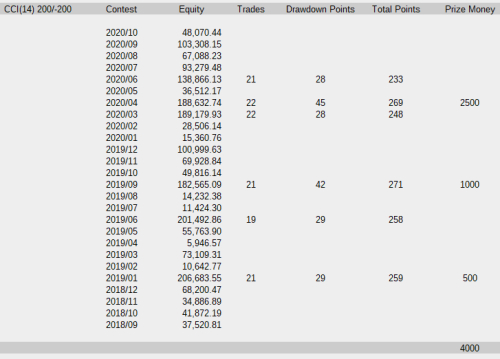

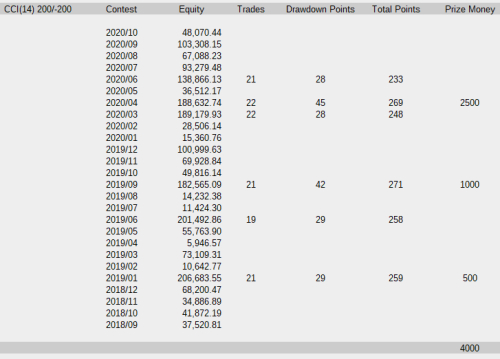

I have tested three different manually selected entry signals based on Commodity Channel Index, Relative Strength Index and Bollinger Bands indicators. For the sake of simplicity I've used the same time period on all three indicators. Furthermore, positions were taken in the direction of short-term momentum. Expected prize money was calculated using past contest data from the period from 2018/09 to 2020/10.

The sample may be a bit on the small side, but from the above results we see that the signal based on RSI indicator clearly outperforms BB in CCI under these settings. Of course, it would be better if we had performed optimization using many parameters (time period, indicator settings, SL, TP, instrument, trading hours, ...) but that's beyond the scope of this article.

I'd like to thank to Dukascopy for the prize and for organizing this contest, which gives us opportunity to win funds for our trading accounts, expand our knowledge of markets and automated trading, and hone our programming skills at the same time.

To recap, the basic properties of the strategy are:

- the strategy trades once per trading day

- a position is "expected" to hit its take-profit order shortly after the position is opened

- in the event of a larger drawdown, the strategy enters recovery mode

I have tested three different manually selected entry signals based on Commodity Channel Index, Relative Strength Index and Bollinger Bands indicators. For the sake of simplicity I've used the same time period on all three indicators. Furthermore, positions were taken in the direction of short-term momentum. Expected prize money was calculated using past contest data from the period from 2018/09 to 2020/10.

The sample may be a bit on the small side, but from the above results we see that the signal based on RSI indicator clearly outperforms BB in CCI under these settings. Of course, it would be better if we had performed optimization using many parameters (time period, indicator settings, SL, TP, instrument, trading hours, ...) but that's beyond the scope of this article.

I'd like to thank to Dukascopy for the prize and for organizing this contest, which gives us opportunity to win funds for our trading accounts, expand our knowledge of markets and automated trading, and hone our programming skills at the same time.