Full report available here

Summary

Summary

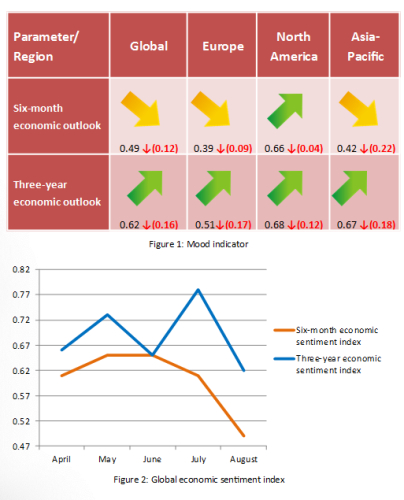

- China’s “Black Monday” crash on August 24 not only triggered panic among investors all around the world, but also significantly undermined professors’ sentiment as all indexes plunged sharply. A near 9% decline in the Shanghai Composite index, the biggest one-day decrease since 2007, reverberated around global markets, sending other stock exchanges from Sydney to Wall Street tumbling. As worries go well beyond China’s immature stock market, signs are mounting that the world’s second largest economy is slowing at an even faster pace than Beijing estimated, fuelling fears the global economy heads for a renewed crisis. After growing 7.4% last year, there are doubts that the Chinese economy can reach this year’s lower target of 7%. Despite a string of interventions by Beijing, including an unexpected devaluation of the Yuan this month, the world’s growth engine appears to be spluttering.

- Now everyone is left with the question “What does the turmoil in China mean for the rest of the world? To what extent the recent adverse developments in China will impact other economies? And will central banks adjust their monetary policy to cushion economies and ensure sustainable growth?”

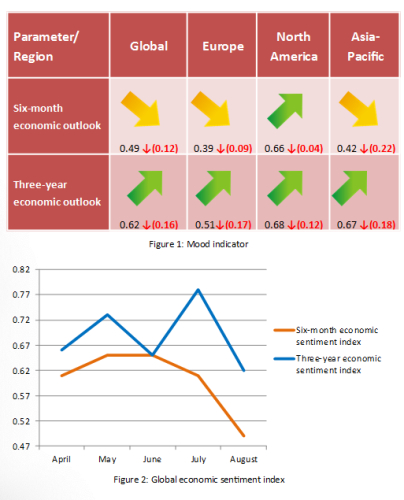

- Meanwhile, professors who took part in August Dukascopy Sentiment Index poll appeared to be increasingly concerned about the world’s leading economies, as their both short and long term economic outlook darkened.