Consumer Price Index (CPI)

Definition: The CPI is a consumer-level index designed to measure pure price change of a fixed market basket of goods and services, representative of the purchases of a typical urban consumer. CPI is classified among the economy-wide indicators which are the broadest measures of productive activity and record the result for an entire economy.

The Core CPI is calculated in the same manner as the CPI but it excludes items with high volatility such as energy and food which are vulnerable to price shocks, leading to a distortion in the CPI calculation.

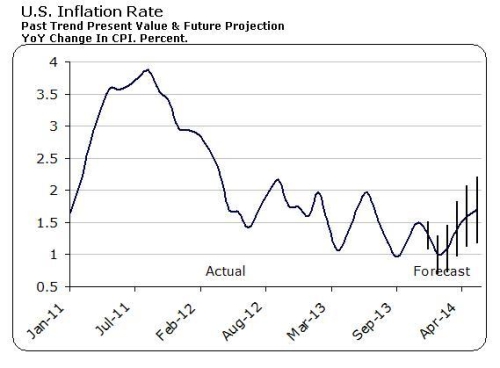

Why does it matter? It is considered to be one of the most effective indicators revealing the current state of inflation in an economy. The inflation rate, which is the rate at which prices of goods and services change, is determined by the economy's need for money and by the supply of money. In order to determine whether the money supply is great enough to meet the needs of the economy, we need to know the inflation rate. Inflation data is also needed to monitor the effectiveness of a monetary policy in its effort to promote maximal economic growth.

Economic growth has to be understood in a cycle made of inflation and interest rates. Growth typically creates higher wages and full employment, which increases the aggregate demand. When inflation begins to escalate too fast, it deteriorates asset values and it affects savings - people are unable to save money because of higher prices. In order to control

inflation in periods of economical expansion, the Federal Reserve (that is the US monetaryauthority) will adjust interest rates to cool off the economy. Higher interest rates curb expansion as it makes growth more expensive reflecting the fact that the cost of money is higher.

When inflation is low and growth is also falling, the Federal Reserve can lower interest rates in order to stimulate growth.

The inflation rate is determined by the general price increases of consumer goods and services over time. The best way to measure it is using an index which reduces the prices that consumers spend in one year to a simple number that can be easily compared to other years. Based on a starting index value of 100, if the CPI for the current period is, let's say, 114, the indication is that it now costs 14% more to buy the basket of goods today than it was when the index was first established (in 1982-84). By comparing the monthly CPI data, you can easily detect changes in consumer's buying power from month to month.

Acceleration or deceleration of inflation, as signaled by the rate of change of the CPI, can indicate that a change in monetary policy may be appropriate.

A CPI that continues to trend upwards month over month could be a signal that inflation is eroding buying power to the point that the central bank will raise interest rates to curb spending. As a result, an increase in interest rates may lead to an increase in demand for the currency as its higher interest rates make the currency more attractive for global investors, as we have seen in the above real interest rate differential model.

In any case, in times when there are concerns about inflation, the CPI gains in importance despite its limitations. As with other indicators - even technical ones - don't worry too much about its handicaps and try to extract the valuable information it contains.

Understanding CPI can be translated in trade opportunitie sand guidance in managing their overall risk. It is not because of its inherent value but because of the attention that traders pay to it that CPI is relevant.

Specially important for traders and analysts are the developing trends in CPI results and the breaking points between inflationary and deflationary periods.

Released by: US Department of Labor; Bureau of Labor Statistics. Look for “Consumer Price Index

Summary”, as it is the most popular measure of inflation.

Frequency: CPI results are published on a monthly basis.Generally available the second week of the month immediately following the month for which data is being released. It's always released after the Producer Price Index.

Note also that in the USA most indicators are published on certain weekdays, rather than on a monthly date.

I will continue on the next blog.

Please,visit and comment my article :

The Art of Ichimoku