Hello all, I'm really happy to be nominalized as the winner of strategy contest, where I finished on the 3 rd place on January 2019 and I want to thank you on this way to the Dukascopy team for the opportunity that they gave to us, to developing and to innovate new ideas together with other competitors.

I'm participating in this contest from when it started and I'm pleased to share the ideas with other participants about the strategy contest.

The idea to go with this strategy came after a while after I starting to analyze the pattern of the graphics and I noticed are some specific movements that are repetitive and I started to implement this in my strategy.

The strategy was based on one currency pair, the EUR/USD on a 15 minutes time frame. This pair was chosen because looks more stable than the others and the bid-ask spread is lower comparative with other currency. The 15 minutes time frame was chosen specifically to make scalping and to earn a small profit each time.

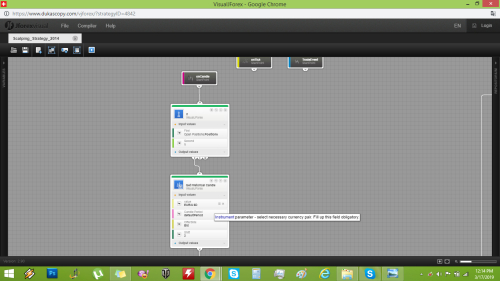

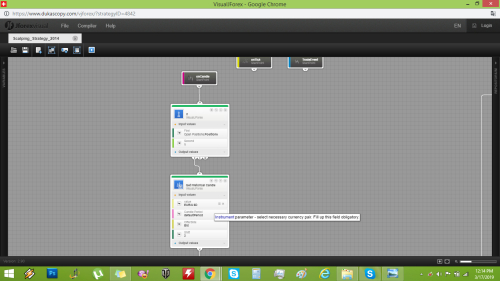

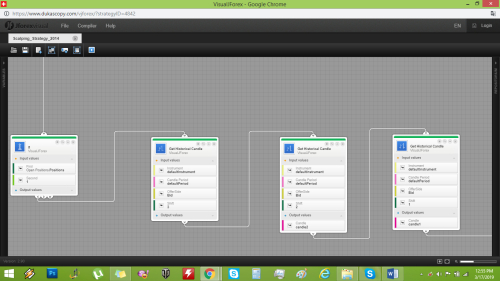

Fig.1

Fig.1

In fig 1, above the default period was 15 minutes as earlier mentioned to and the instrument is the EURUSD.

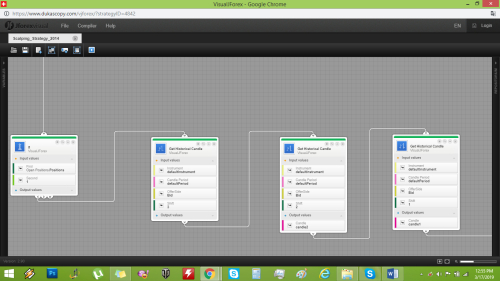

Fig.2

Fig.2

In fig.2, which is presented above, the strategy is using "Get historical candle" on a 15-minute time frame on Eur/Usd currency, for the last 3 candles and is analyzing the graph to see if meets the conditions to open transaction.

It analyzes those candles for a specific pattern: for one candle in one direction and the next two in the opposite direction, it follows the trend of the last two, on buy if the trend is upward or sale if the trend is downward.

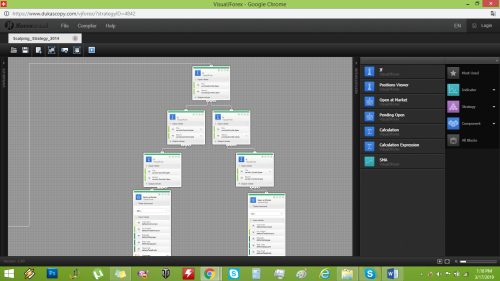

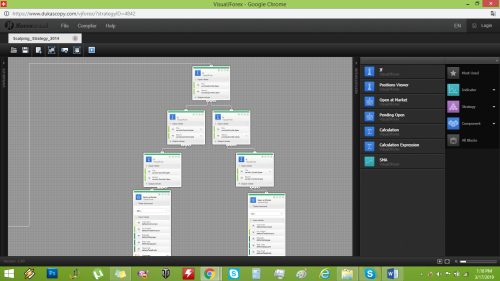

Fig.3

Fig.3

In the fig.3 it shows when the strategy meets already the conditions on a 15-minutes time frame and it starts to place the transaction in market, on buying or selling. For this strategy I set a small take profit around 8 pips, that's easy to be achieved and also I'm using a large Stop Loss that is set at 200 pips because the market movement sometimes can be very volatile and to prevent the slippage.

The strategy has a good efficiency constantly but sometimes because of the market turbulence can fail. Improvement in the risk-reward ratio is another aspect that I need to analyze because the stop-loss some times when the market is unstable can be reached easily and to destabilize the strategy.

I'm participating in this contest from when it started and I'm pleased to share the ideas with other participants about the strategy contest.

The idea to go with this strategy came after a while after I starting to analyze the pattern of the graphics and I noticed are some specific movements that are repetitive and I started to implement this in my strategy.

The strategy was based on one currency pair, the EUR/USD on a 15 minutes time frame. This pair was chosen because looks more stable than the others and the bid-ask spread is lower comparative with other currency. The 15 minutes time frame was chosen specifically to make scalping and to earn a small profit each time.

Fig.1

Fig.1 In fig 1, above the default period was 15 minutes as earlier mentioned to and the instrument is the EURUSD.

Fig.2

Fig.2In fig.2, which is presented above, the strategy is using "Get historical candle" on a 15-minute time frame on Eur/Usd currency, for the last 3 candles and is analyzing the graph to see if meets the conditions to open transaction.

It analyzes those candles for a specific pattern: for one candle in one direction and the next two in the opposite direction, it follows the trend of the last two, on buy if the trend is upward or sale if the trend is downward.

Fig.3

Fig.3In the fig.3 it shows when the strategy meets already the conditions on a 15-minutes time frame and it starts to place the transaction in market, on buying or selling. For this strategy I set a small take profit around 8 pips, that's easy to be achieved and also I'm using a large Stop Loss that is set at 200 pips because the market movement sometimes can be very volatile and to prevent the slippage.

The strategy has a good efficiency constantly but sometimes because of the market turbulence can fail. Improvement in the risk-reward ratio is another aspect that I need to analyze because the stop-loss some times when the market is unstable can be reached easily and to destabilize the strategy.