Full report available here.

Summary

Summary

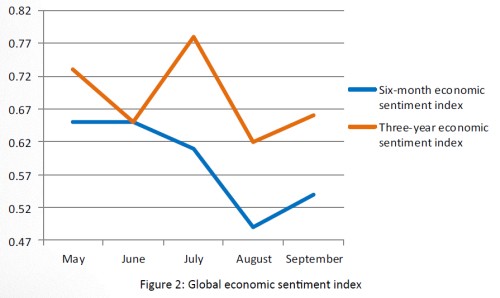

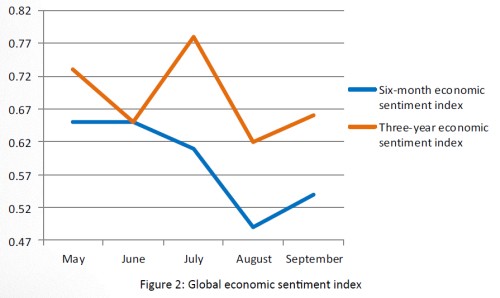

- China's "Black Monday" crash on August 24 triggered a tornado which swept through the global economies and equity markets, sowing panic among investors, policy makers and ordinary people, but, as it faded, economic sentiment seemed to restore. September release of Dukascopy Bank Sentiment index revealed that all indices which show academia experts evaluation of regions’ short and long-term economic prospects rebounded after precipitous declines in the preceding month.

- Nevertheless, fears continued to engross economists’ and analysts’ minds, particularly after central bankers around the world voiced concerns over the Chinese economy and the spill-over effect it might have on other economies.

- North America enjoyed the biggest bounce-back of its sentiment indices in September, compared to other regions. The rebound came even despite the fact that the Fed decided to delay the long-anticipated interest rate hike, suggesting the US economy was not robust enough to weather recent developments.

- Europe’s and Asia-Pacific’s sentiment indices recovered as well, but remained at historically low levels. The regions’ short-term gauges remained in negative territory in September.