Full report available here .

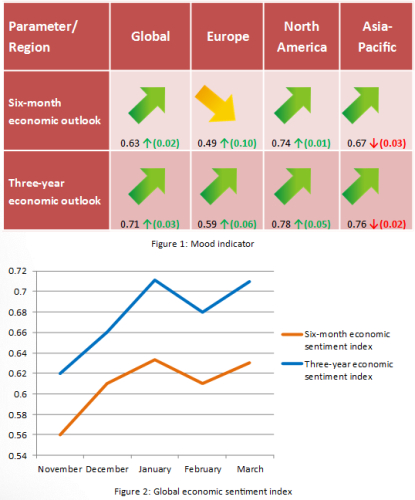

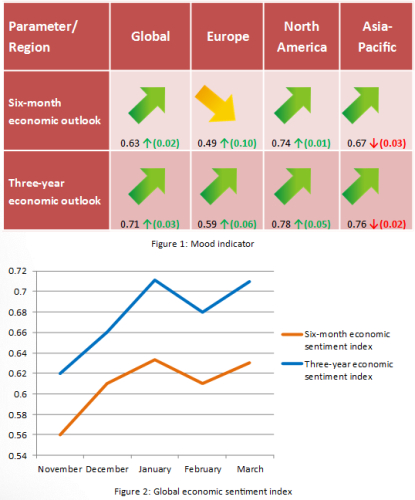

- One of the biggest stories on the global economic arena remains the weakness in commodity prices, particularly oil. Precipitous decline in crude oil over the past several months has been expected to be a net positive for many developed and emerging countries including the US, Europe, India, and China, which are net oil importers. However, oil and commodity exporters such as Canada and Australia have already been severely hit by decline in commodities. Adding to this diverging monetary policy around the world, we get a two-speed global economic recovery. Yet, both short and long term outlook continues to improve, as findings of Dukascopy Sentiment Index survey showed in March.

- Professors’ sentiment towards Europe’s six month economic outlook skyrocketed in March, jumping to 0.49 up from 0.39 in the preceding month. It appears the the short and long term economic expectations have brightened as ECB has launched its massive 1 trillion QE programme on March 5 and Governor Mario Draghi's has stated a sustained economic recovery is finally taking hold in the currency bloc thanks to the central bank's stimulus as well as cheaper oil prices.

- While uncertainty remains over the timing of US interest rate hike and Canada suffers from plunging oil prices, professors were confident in the region’s economic future. Both six-month and three-year economic outlook improved in March.

- Central banks in China, Australia, Japan and New Zealand decided to maintain their accommodative monetary policy stance in March to support their economies, further indicating that the region’s economy has been struggling due to a number of international and domestic headwinds. Thus, six-month and three-year economic sentiment index declined in March, reflecting professors’ concerns over the Asian-Pacific economy’s health.