Hello everyone!

The fundamental reason of russian ruble's weakening is foreign currency supply decline in Russia. That has two roots. The first on is that russian banks cannot borrow money (usd, euro) from western banks becuse of Ukraine-related sanctions, and the second is crude oil price falling.

If the second one could be improved by market, the only way to fix first troube is to return Crimea and go away from eastern Ukraine. I don't think that Putin will do it, so USDRUB is very bulish on long-term.

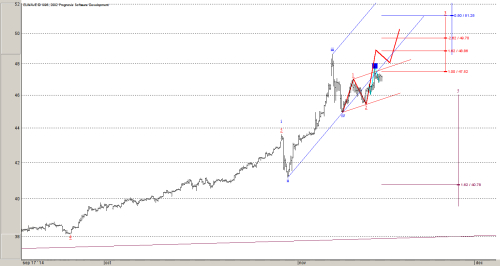

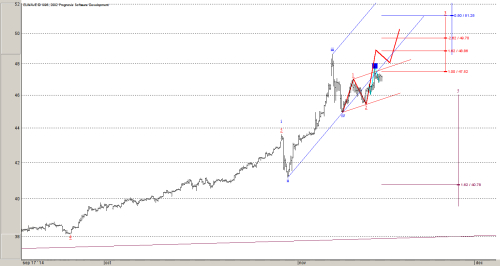

The currency pair is in an Extension 1 impulsive pattern since June 2014 (movement from 33.54). The 5th wave of that pattern is going to go up to a range 48.7-53. Afther that USDRUB will fall to 40-42 in 6-12 months.

The wave v Minute internal structure.

The fundamental reason of russian ruble's weakening is foreign currency supply decline in Russia. That has two roots. The first on is that russian banks cannot borrow money (usd, euro) from western banks becuse of Ukraine-related sanctions, and the second is crude oil price falling.

If the second one could be improved by market, the only way to fix first troube is to return Crimea and go away from eastern Ukraine. I don't think that Putin will do it, so USDRUB is very bulish on long-term.

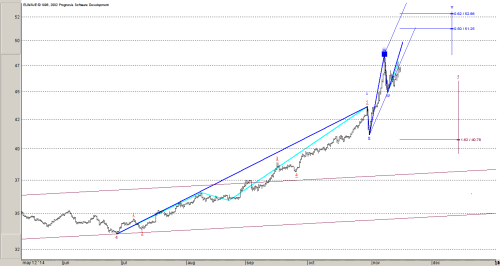

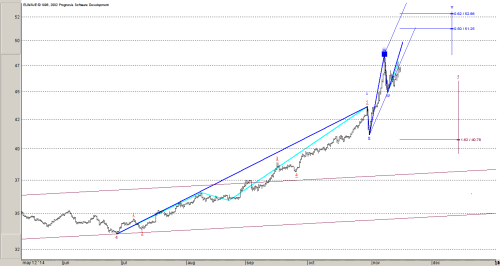

The currency pair is in an Extension 1 impulsive pattern since June 2014 (movement from 33.54). The 5th wave of that pattern is going to go up to a range 48.7-53. Afther that USDRUB will fall to 40-42 in 6-12 months.

The wave v Minute internal structure.