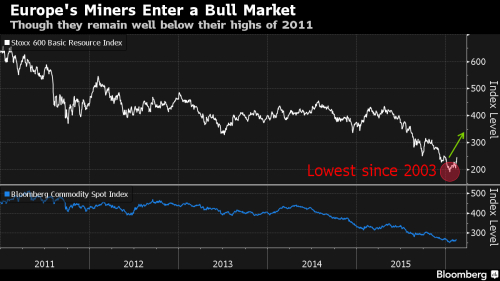

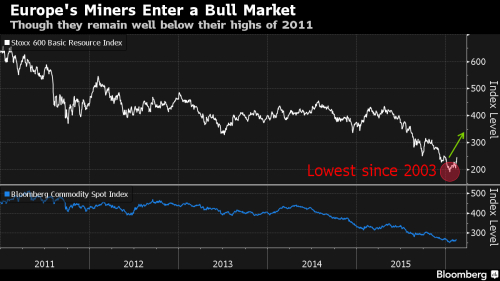

A rally that pushed miners toward a bull market and better-than-estimated corporate earnings sent European stocks to a two-week high.

Commodity producers erased this year’s losses, up 27 percent from last month’s low, to lead the rebound in the Stoxx Europe 600 Index, which gained 2.6 percent at 4:32 p.m. in London. Glencore Plc rallied 15 percent after saying it signed new loan commitments.

Automakers posted the second-best Stoxx 600 performance, helped by a weakening euro. Credit Agricole SA jumped 14 percent and Schneider Electric SE rallied 9.2 percent after their earnings topped projections.

“I’d love to think this is the start of a lasting rebound but it’s too early to tell,” said Justin Urquhart Stewart, co-founder of Seven Investment Management in London. His firm oversees about $13 billion. “Any gains have been pretty fragile and short-lived lately, even though earnings haven’t been all that bad and economic figures have been quite supportive. Confidence seems to only return for a few days.”

After a rout this year triggered by a deepening oil rout, concern over global-growth prospects and dissipating faith in central-bank support, Europe’s stocks have become cheaper. Stoxx 600 firms are trading at 14.5 times estimated earnings, down from a multiple of 17.3 in April, and the benchmark is rising today for the third time in four days.

All but one of the 47 members on the Stoxx 600 banking gauge climbed. Lenders have been among the most battered in this year’s selloff, slumping as much as 29 percent to a three-year low last week amid worries over bad loans at Italian peers, the impact of a low-rate environment on profits and Deutsche Bank AG’s creditworthiness.

Every western-European national benchmark gained at least 1.7 percent, with those in Norway and Sweden up 3.5 percent or more. Greece’s ASE Index and Italy’s FTSE MIB Index, this year’s worst performers, rose 2.5 percent.

Among other stocks active on corporate news, Norsk Hydro ASA climbed 12 percent after lowering its costs and posting a record quarterly production of bauxite and alumina. RWE AG tumbled 12 percent after suspending its dividend for holders of ordinary shares. Societe BIC SA slid 8 percent after saying its chief executive officer will retire and its chairman will take on his role.

Commodity producers erased this year’s losses, up 27 percent from last month’s low, to lead the rebound in the Stoxx Europe 600 Index, which gained 2.6 percent at 4:32 p.m. in London. Glencore Plc rallied 15 percent after saying it signed new loan commitments.

Automakers posted the second-best Stoxx 600 performance, helped by a weakening euro. Credit Agricole SA jumped 14 percent and Schneider Electric SE rallied 9.2 percent after their earnings topped projections.

“I’d love to think this is the start of a lasting rebound but it’s too early to tell,” said Justin Urquhart Stewart, co-founder of Seven Investment Management in London. His firm oversees about $13 billion. “Any gains have been pretty fragile and short-lived lately, even though earnings haven’t been all that bad and economic figures have been quite supportive. Confidence seems to only return for a few days.”

After a rout this year triggered by a deepening oil rout, concern over global-growth prospects and dissipating faith in central-bank support, Europe’s stocks have become cheaper. Stoxx 600 firms are trading at 14.5 times estimated earnings, down from a multiple of 17.3 in April, and the benchmark is rising today for the third time in four days.

All but one of the 47 members on the Stoxx 600 banking gauge climbed. Lenders have been among the most battered in this year’s selloff, slumping as much as 29 percent to a three-year low last week amid worries over bad loans at Italian peers, the impact of a low-rate environment on profits and Deutsche Bank AG’s creditworthiness.

Every western-European national benchmark gained at least 1.7 percent, with those in Norway and Sweden up 3.5 percent or more. Greece’s ASE Index and Italy’s FTSE MIB Index, this year’s worst performers, rose 2.5 percent.

Among other stocks active on corporate news, Norsk Hydro ASA climbed 12 percent after lowering its costs and posting a record quarterly production of bauxite and alumina. RWE AG tumbled 12 percent after suspending its dividend for holders of ordinary shares. Societe BIC SA slid 8 percent after saying its chief executive officer will retire and its chairman will take on his role.