Today is the most awaited Non Farm Payroll data release since the Fed start tapering and cut back the quantitative easing programme. Although Fed decided to do a small tapering and only cutting back their stimulus programs by a minor 10B, Ben Bernanke has said during the press conference that any further cut in QE is data depending and "end of QE certainly won't be at mid-year" suggesting that it will take longer before they will end the QE programme for good.

The market consensus for today's release is that the employment will increase another 200K which is similar to what we have seen in previous month November (203k) and October(200K). The unemployment rate is seen to remain also unchanged at 7%. And after yesterday's Initial Jobless Claim came in better than expected at 330K the expectation for today NFP data have increased.

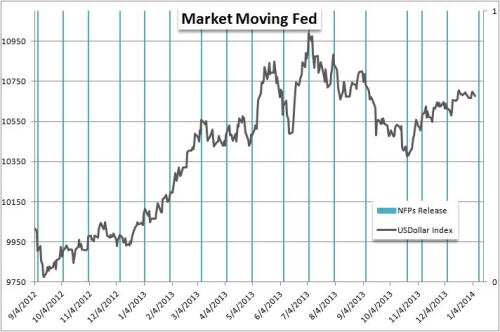

- Figure 1. Market Moving Fed: NFP's release & US Dollar Index.

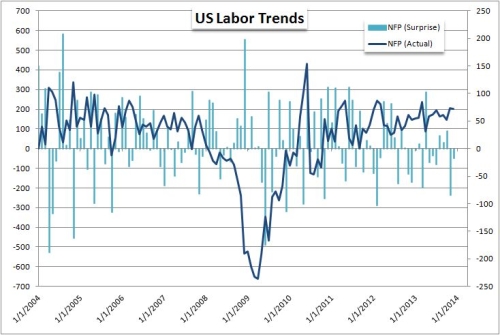

In Figure 1 you can see how the Dollar reacted previously on each NFP release and based on this you can make a better expectation on what to expect during NFP release and more importantly how the US dollar will behave. In the second figure (see Figure 2) I want to bring to your attention what was the difference between the actual NFP numbers and the NFP surprises.

- Figure 2. US Labor trends.

Best Regards,

Daytrader21.