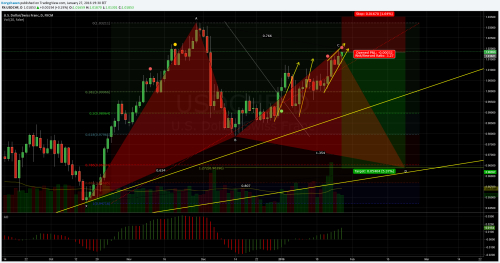

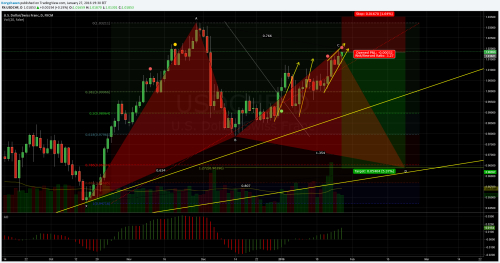

Hi traders, today I would like to share an idea of mine regarding harmonic patterns. On the USDCHF pair there is a potential Gartley pattern unfolding. I must say that I only trade harmonic pattern when they are backed by Elliott wave counting. And this is such a situation. There was an impulsive move, the wave 1 of a 5 wave motive move, the XA leg, which is now followed by wave 2, a so called ZigZag corrective structure, which, in my opinion, will be the AB=CD pattern that forms usually the Gartley pattern. This entry, shown on the chart below, is an aggressive C point entry, with SL above the A point, but it could be very profitable, if it unfolds like I think it will. And at the D point, we can go long, but until then it will take several days, or weeks. Good luck if somebody is taking this trade, I am already short on it on my live account!