With the now officially concluded winter and spring blooming after the Easter holidays, traders are starting to look seriously profit opportunities, focusing attention on the action of central banks and on economic data. April 1 will be released the employment report, crucial. Many expect that the data can contribute significantly to a possible rise in interest rates by the Federal Reserve in April or in June. With inflation beginning to rise slowly and with an upward revision of estimates on GDP, the Fed will have to react to not act too late. During the last session, the dollar rebounded as a result of the Fed members statement, increasingly in favor of a rate increase. On Monday, the dollar rose to 96.39 level, and then move downwards due to disappointing data and close down by 20 points at stake 95,97.

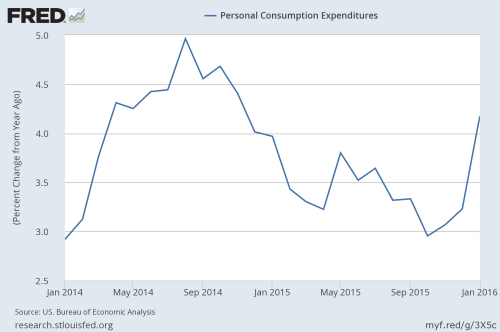

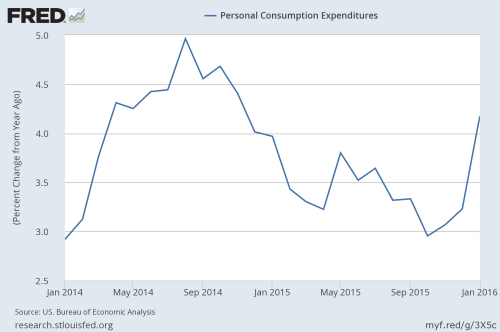

In February, spending on US consumption There was a slight increase for the third consecutive month, while the income growth showed a marked slowdown. According to data released by the Commerce Department on Monday, in February, the consumer spending increased by 0.1%, marking a result in line with the disappointing increase in January and December. In February, personal incomes rose by a modest 0.2%, after the much stronger increase of 0.5% in January. The slowdown reflects the 0.1% reduction suffered by wages, representing the first decrease since September.

Despite the recent weakness, economists expect an increase in consumer spending during the year, as the net increase employment is expected to increase incomes and stimulate spending. The indicator of prices followed by the Federal Reserve showed that, in February, the prices decreased by 0.1% and have recorded an annual increase of just 1%.

The weakness of the expenditure was expected, in the light of the data that had shown a decline in retail sales in February, caused by the decrease in petrol sales.

On Monday, with British markets still closed for the Easter holidays, they were not published data on the Eurozone. The euro gained 34 points to be negotiated 1.12 share, while the pound has been moving in upwards of 117 points to reach 1.4243 share. As for the Eurozone, it will be interesting to analyze the different indices of the Directors of the manufacturing sector purchases in search of signs of improvement resulting from the stimulus measures adopted recently by the European Central Bank.

On Wednesday, the European Commission will publish its report on business confidence and consumer for the harvest of March.

In the UK, the day Thursday will see the publication of data on fourth quarter GDP, the loans approved during the month, on the money supply and the current balance of current account (deficit) .

In the US, the attention is focused on the employment report, which will be released on Friday, and the economy report of the chairman of the Federal Reserve, Janet Yellen. The intervention, much anticipated, will take place in the day today at the Economic Club of New York.

The employment report is always the most important fact of the month. The results in March, which will be broadcast on Friday, will be examined with particular attention. In the last week, the president of the St. Louis Fed, James Bullard, told Bloomberg that the employment data, should strongly positive, "might encourage" a rise in interest rates in April. In December, the US central bank raised interest rates for the first time in nearly a decade. However, in January and in March, the turbulence of the global economy have led the monetary authorities to keep interest rates at a record low of 0.4%. In February, following a decline of 172,000 jobs in January, employment increased by 242,000 new jobs. Another increase of around 200,000 new jobs would confirm the improvement in consumption and the housing market recovery, outcomes that could more than offset the slowdown in industrial production and business investment. According to economists, the Labor Department is expected to announce 200000 new jobs.

In February, spending on US consumption There was a slight increase for the third consecutive month, while the income growth showed a marked slowdown. According to data released by the Commerce Department on Monday, in February, the consumer spending increased by 0.1%, marking a result in line with the disappointing increase in January and December. In February, personal incomes rose by a modest 0.2%, after the much stronger increase of 0.5% in January. The slowdown reflects the 0.1% reduction suffered by wages, representing the first decrease since September.

Despite the recent weakness, economists expect an increase in consumer spending during the year, as the net increase employment is expected to increase incomes and stimulate spending. The indicator of prices followed by the Federal Reserve showed that, in February, the prices decreased by 0.1% and have recorded an annual increase of just 1%.

The weakness of the expenditure was expected, in the light of the data that had shown a decline in retail sales in February, caused by the decrease in petrol sales.

On Monday, with British markets still closed for the Easter holidays, they were not published data on the Eurozone. The euro gained 34 points to be negotiated 1.12 share, while the pound has been moving in upwards of 117 points to reach 1.4243 share. As for the Eurozone, it will be interesting to analyze the different indices of the Directors of the manufacturing sector purchases in search of signs of improvement resulting from the stimulus measures adopted recently by the European Central Bank.

On Wednesday, the European Commission will publish its report on business confidence and consumer for the harvest of March.

In the UK, the day Thursday will see the publication of data on fourth quarter GDP, the loans approved during the month, on the money supply and the current balance of current account (deficit) .

In the US, the attention is focused on the employment report, which will be released on Friday, and the economy report of the chairman of the Federal Reserve, Janet Yellen. The intervention, much anticipated, will take place in the day today at the Economic Club of New York.

The employment report is always the most important fact of the month. The results in March, which will be broadcast on Friday, will be examined with particular attention. In the last week, the president of the St. Louis Fed, James Bullard, told Bloomberg that the employment data, should strongly positive, "might encourage" a rise in interest rates in April. In December, the US central bank raised interest rates for the first time in nearly a decade. However, in January and in March, the turbulence of the global economy have led the monetary authorities to keep interest rates at a record low of 0.4%. In February, following a decline of 172,000 jobs in January, employment increased by 242,000 new jobs. Another increase of around 200,000 new jobs would confirm the improvement in consumption and the housing market recovery, outcomes that could more than offset the slowdown in industrial production and business investment. According to economists, the Labor Department is expected to announce 200000 new jobs.