Last week I've been giving out my own analysis on the yen pairs,arguing that we may see a rebound in the XXX/JPY currency pairs, you can find my blog post here: Still Confused about XXX/JPY Sell Of? What's next My whole analysis was around the point that Nikkei index which was at an important pivotal point is about to resume the uptrend and thus dragging the XXX/JPY pairs in the direction of the main trend.

Best Regards,

Daytrader21

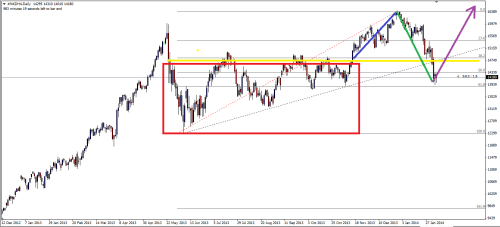

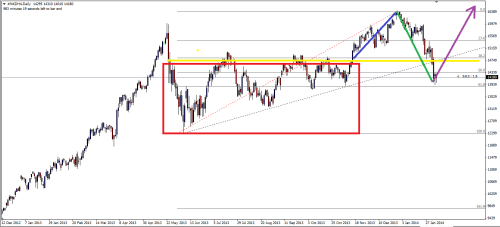

- Figure 1. Nikkei Index Last week price action.

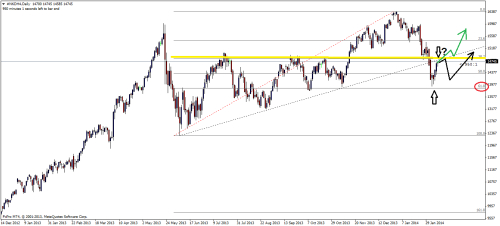

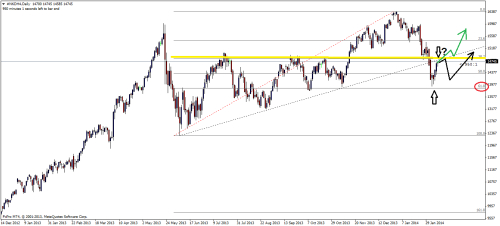

- Figure 2. Nikkei Index Daily Chart.

Best Regards,

Daytrader21