Even thoughtrading against an established trend can prove dangerous to say the least it

can be worthwhile to take into consideration at least for the purpose of sizing

down the open positions or even closing them until the trend starts showing

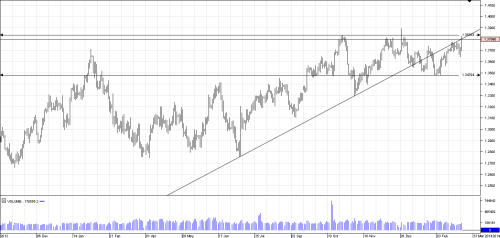

signs of resuming its momentum. Now for the current scenario on theEurUsd pair we can see the trend is bullish, market moving to the upside, even

though its within a larger consolidation pattern. As mentioned earlier counter

trend trading should be used only for closing or sizing down positions. What are

the reasons for suggesting testing the waters with a short trade here? you may

ask me then and with good reason. I only use technical analysys sowill leave out the fundamentals and news regarding the tensions between Russia

and Ukrain which could escalate at anytime. Lets use a top down approach.- on thedaily chart we can see the Euro reaching the top of the trading range it

established starting in September last year- it breached the rising support trend line andnow is coming up to test it- volumesare average to low suggesting not much activity and not enough steam to push

the market up much further

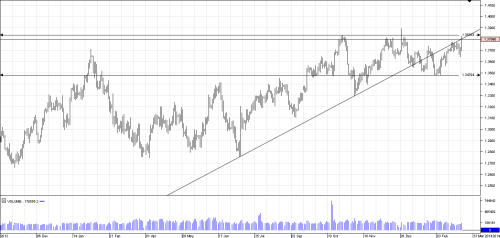

Now lets have a look at the lower 4hchart and notice almost the same things revealing the fractal nature of markets- market isin the upper side of its latest trading range, creating at least a relative

overbought scenario- afterbreaching a similar trendline to the one on the daily, but weaker it tries to

come up to retest it-volumes werevery high only on the explosive move to the upside fallowed by very low

activity which showed little intrest to buying higher.

Does this change the fact that weare in an uptrend? No, of course it doesnt, but this suggests that a trade

against the trade now could develop into a powerful move worth catching. If the market opens at the same levels I wouldconsider selling it with 30 or so pips stop just above the recent highs. Why so

close to the market? well as we can see from the charts the alternative

scenario could be taking out the highs and so breaking out of the entire

consolidation formation, opening the market for strong upside movement.

can be worthwhile to take into consideration at least for the purpose of sizing

down the open positions or even closing them until the trend starts showing

signs of resuming its momentum. Now for the current scenario on theEurUsd pair we can see the trend is bullish, market moving to the upside, even

though its within a larger consolidation pattern. As mentioned earlier counter

trend trading should be used only for closing or sizing down positions. What are

the reasons for suggesting testing the waters with a short trade here? you may

ask me then and with good reason. I only use technical analysys sowill leave out the fundamentals and news regarding the tensions between Russia

and Ukrain which could escalate at anytime. Lets use a top down approach.- on thedaily chart we can see the Euro reaching the top of the trading range it

established starting in September last year- it breached the rising support trend line andnow is coming up to test it- volumesare average to low suggesting not much activity and not enough steam to push

the market up much further

Now lets have a look at the lower 4hchart and notice almost the same things revealing the fractal nature of markets- market isin the upper side of its latest trading range, creating at least a relative

overbought scenario- afterbreaching a similar trendline to the one on the daily, but weaker it tries to

come up to retest it-volumes werevery high only on the explosive move to the upside fallowed by very low

activity which showed little intrest to buying higher.

Does this change the fact that weare in an uptrend? No, of course it doesnt, but this suggests that a trade

against the trade now could develop into a powerful move worth catching. If the market opens at the same levels I wouldconsider selling it with 30 or so pips stop just above the recent highs. Why so

close to the market? well as we can see from the charts the alternative

scenario could be taking out the highs and so breaking out of the entire

consolidation formation, opening the market for strong upside movement.