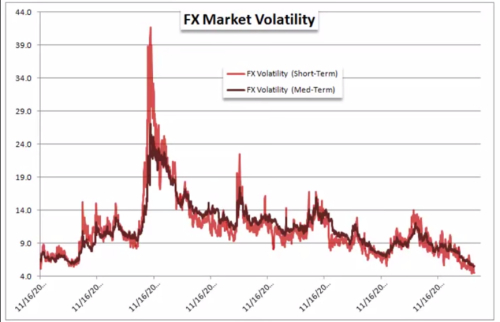

In current low volatility environment (see Figure 1)it's quite hard for investors to pull out some decent profits so the carry trading strategy becomes more attractive as it generate yield. So in this regard if you wish to find more about the carry trade I'll recommend you to read my article: Carry Trade Returns

Here is a quick look on what to expect with my article:

"Historically speaking when it comes to interest rates we are at historic low levels among developed economies, and not only that the rates are so low but recently ECB has surprised the market by going negative rates in an desperate attempt to force people to spend more and thus making inflation to pick up.This idea of negative interest rates is intended to reduce the incentive to save or park money in the currency or bank and as I said before to spend more.

In this environment it makes sense that investors who are chasingyield to rush in and park their money with the countries that are moving away from this easing cycle and are already starting to raise the main interest rates like RBNZ(Reserve Bank of New Zealand). But the market also moves in anticipation of as market expectation for hiking the rates by BOE, sooner than later, have gone up exponentially and that's one of the reasons why we see cable keep pressing higher..............................."

If you wish to read more please follow this link: Carry Trade Returns

Best Regards,

Daytrader21

Figure 1. FX Market Volatility

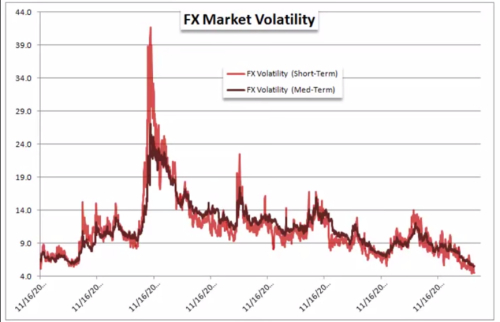

Here is a quick look on what to expect with my article:

"Historically speaking when it comes to interest rates we are at historic low levels among developed economies, and not only that the rates are so low but recently ECB has surprised the market by going negative rates in an desperate attempt to force people to spend more and thus making inflation to pick up.This idea of negative interest rates is intended to reduce the incentive to save or park money in the currency or bank and as I said before to spend more.

In this environment it makes sense that investors who are chasingyield to rush in and park their money with the countries that are moving away from this easing cycle and are already starting to raise the main interest rates like RBNZ(Reserve Bank of New Zealand). But the market also moves in anticipation of as market expectation for hiking the rates by BOE, sooner than later, have gone up exponentially and that's one of the reasons why we see cable keep pressing higher..............................."

If you wish to read more please follow this link: Carry Trade Returns

Best Regards,

Daytrader21