Risk in the market remains elevate by current Russia-Ukraine conflict on the one hand and USA&EU vs Russia sanctions. I'm expecting this geopolitical risks to remain elevate in coming weeks as there are no sign of any de-escalation of this conflict. In this regard we should expect market sentiment to be in risk aversion mode as this is clearly suggested by the lower equity price and higher Treasuries.

Risk in the market remains elevate by current Russia-Ukraine conflict on the one hand and USA&EU vs Russia sanctions. I'm expecting this geopolitical risks to remain elevate in coming weeks as there are no sign of any de-escalation of this conflict. In this regard we should expect market sentiment to be in risk aversion mode as this is clearly suggested by the lower equity price and higher Treasuries.Globally there is more than just Ukraine-Russia conflict we have Gaza-Israel conflict, Iraq, Syria and any of this conflicts can escalate and be the tipping point for risk aversion avalanche as we will unlikely see any improvement to market tone.

There is a high level of uncertainty in the market and the fact that last week US President has authorized the first airstrikes in Iraq since the withdrawal of its forces at the end of 2011 posses a great risk on the longer-term game for the U.S. in Iraq

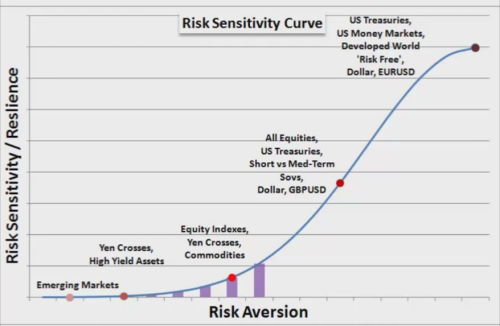

Figure 1 shows the risk sensitive curve and how different assets classes react to the general risk aversion theme as we move along that curve of risk. It's important to understand how each of this instruments reacts to the risk sentiment and which is moving more.

Figure 1. The Risk Sensitive Curve

Contrary to the general believe the geopolitical risk possess a threat to the broad based US dollar bullish sentiment as the risk weighed on 10-year yields which has hit a 14 months low and has also limited any upside movement in the dollar for the time being. If you look on the sensitive curve only in a higher risk environment can trigger the safe haven status of US dollar. And especially when it comes to EUR/USD who is less sensitive to this issues as it's on the higher end of this risk sensitive curve so only an escalation of the general risk can trigger some movements in EUR/USD.

Even if you're just a technical trader keeping in mind where the probability lies in current risk aversion environment can help your trading operations a lot, so keep an eye on how this events develop and on the risk sensitive curve.

Best Regards,

Daytrader21