Going into today's NFP release there is a rumors going on around the markets that NFP figures will be well below consensus. Over the past few months March payrolls have missed on 6 of the last 7 reports this shows a strong seasonality pattern. Since FED has removed "patience" from their

Going into today's NFP release there is a rumors going on around the markets that NFP figures will be well below consensus. Over the past few months March payrolls have missed on 6 of the last 7 reports this shows a strong seasonality pattern. Since FED has removed "patience" from their statement the market is more sensitive to the job report as market participants will beat on a rate hike sooner/later depending if the figures comes strong/weaker.

We have to keep in mind that today is holiday trading sessions which means liquidity is low, and it can either take out a lot of the momentum or the market movement to be exacerbate. Knowing the liquidity expectation we have to adopt a defensively risk management approach.

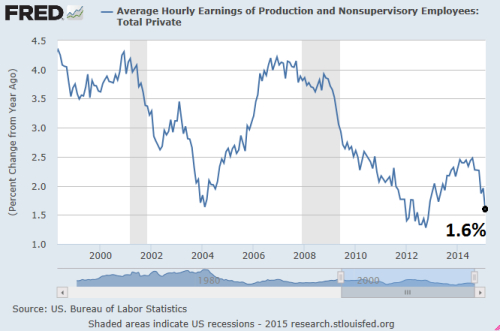

The details matter most now as the market movements is data dependent and with Fed dual mandate to keep low level of unemployment and steady inflation the US Average Hourly Earnings, which are going to be released at about the same time, will be key. Feds target for inflation is 2% and what feeds inflation is generally consumer ability to spend, they need to have capital either from credit or if they have higher wages that is what contribute to their purchasing power and subsequently feeds inflation into the market.

Figure 1. Average Hourly Earnings

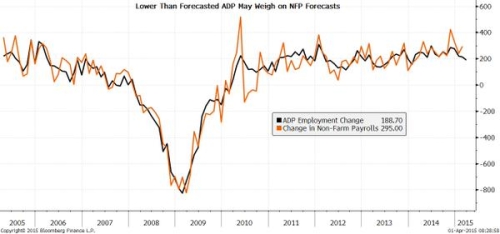

So if the US Average Hourly Earnings comes weaker it can push further in time the hike rate expectation which in turn can be negative for the dollar in the short term. The average hourly earnings has been falling (see Figure 1) and this may weight a great deal on the dollar reaction. If we take in consideration the March ADP figures was lower than forecasted this may also weigh on NFP forecasts (see Figure 2) and us such we can expect a lower figure.

Figure 2. ADP vs NFP Forecasts

NFP figures:

- Previous: 295k;

- Expectation: 244K;

Unemployment rate:

- Previous: 5.5%;

- Expectation: 5.5%;

Average Hourly Earnings:

- Previous: 0.1%;

- Expectation: 0.2%;

Best Regards,

Daytrader21