Due to the 4th of July US holiday, the NFP report will be release 1 day earlier and not the usual first Friday of the month.

Due to the 4th of July US holiday, the NFP report will be release 1 day earlier and not the usual first Friday of the month. The market forecast for today's reading has quite a big rage starting from as low as 231k to as high as 270k down from previous reading of 280k. The only thing stable and where there is a consensus is for the unemployment rate to drop from 5.4% down from 5.5%.

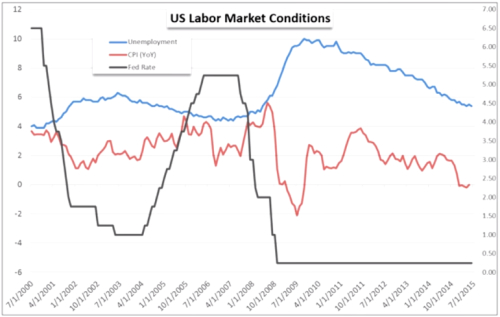

Despite the recent global turmoil the US job market is quite strong as over the past months we had 15th times readings above the 200k and the US employment has increased for 56 straight months.

Also the average hourly earnings for private-sector workers is up 2.3% which in turn can boost inflation and be a catalyst for FED to be more confident in hiking rates. Also the unemployment rate is one of the FED key tool mandates for the FED's monetary policy making (aka interest rate hike).

Figure 1. US Labor Market Conditions

PS: Happy 4th of July to my Americans fellow traders.

Best Regards,

Daytrader21