I was bullish on Euro. However, the price is dauntingly high at the moment. Chasing exteme beauties is not my cup of tea. Therefore, I needed to find some pair that runs generally in sympathy with Euro but not over-bought like Euro. Pound sterling looks like an ideal candidate!

Prior to the nonFarm news, GBP/USD had been wobbling precariously on top for a while and then sliding steadily down, to the point of breaking down. After the nonFarm news further hammered it down some more, I decided it was the time to place an entry.

However, I under-estimated the power of momentum. It continued to fall, further and further down. I felt a sense of despair. Fortunately I wisely used a small position of 2 mil instead of the usual 5 mil size, thus avoiding a stop-out over the weekend margin requirement.

Looking behind, my trade was not a good one. I could have been more patient, waiting for an ideal entry point. Nevertheless, I let out a sigh that GBP recovered about half of the paper loss, giving me some hope of seeing the light again.

The following 4-hourly chart shows it may be moving laterally within the bounds of a triangle pattern. Although it rebounded successfully from support A, it may fall a little further down to trend line support B. If it is truy in sympathy with bullish Euro, GBP should break out into a new rally after the triangular consolidation. At least I should be able to exit with a mild profit.

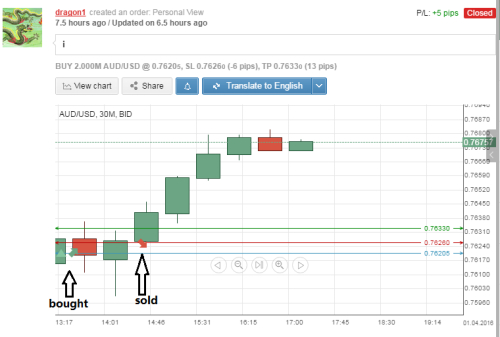

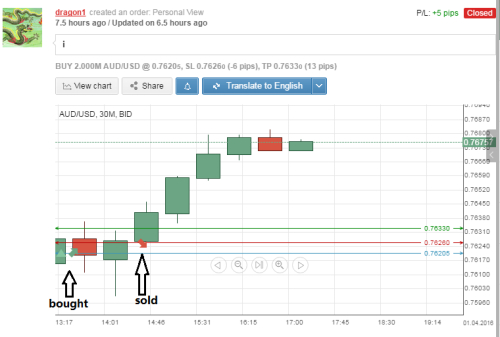

I later also entered AUD/USD betting on its continual bullish move. However, I soon realized that I over used my margin by the weekend leverage rule. I thus exit in a rush to avoid a stop-out. Naturally, whatever I sell, flies.

Prior to the nonFarm news, GBP/USD had been wobbling precariously on top for a while and then sliding steadily down, to the point of breaking down. After the nonFarm news further hammered it down some more, I decided it was the time to place an entry.

However, I under-estimated the power of momentum. It continued to fall, further and further down. I felt a sense of despair. Fortunately I wisely used a small position of 2 mil instead of the usual 5 mil size, thus avoiding a stop-out over the weekend margin requirement.

Looking behind, my trade was not a good one. I could have been more patient, waiting for an ideal entry point. Nevertheless, I let out a sigh that GBP recovered about half of the paper loss, giving me some hope of seeing the light again.

The following 4-hourly chart shows it may be moving laterally within the bounds of a triangle pattern. Although it rebounded successfully from support A, it may fall a little further down to trend line support B. If it is truy in sympathy with bullish Euro, GBP should break out into a new rally after the triangular consolidation. At least I should be able to exit with a mild profit.

I later also entered AUD/USD betting on its continual bullish move. However, I soon realized that I over used my margin by the weekend leverage rule. I thus exit in a rush to avoid a stop-out. Naturally, whatever I sell, flies.