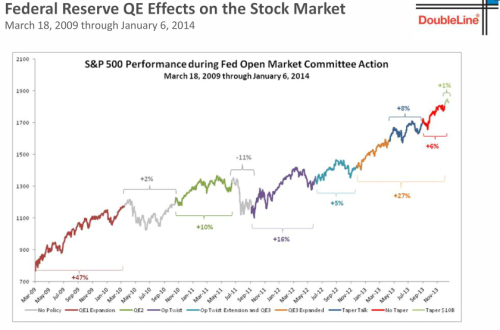

In some cases a picture is worth a thousand words and especially if you're a trader a chart can be self explanatory.

- Figure 1. Federal Reserve QE Effects on the Stock Market(click on the figure to enlarge).

Should tapering inverse the current up cycle in the stock market and are we now heading lower? I know this is a simplistic approach because the world is much more complex than this simple cause-effect relationship. Forecasting the market from a purely domestic economy perspective is flawed as everything in today's globalized world is interconnected so the key is to look at things on a global perspective. We're currently in an shift in cycles where capital flow moves from public to private sector as investor confidence in governments is going lower. So although we may see some kind of correction I'm not expecting the current up trend set in motion to be altered, in order for that to happen we need to go through an euphoria phase where retail traders are hugely investing in the stock market which is not the case now as the current figures show that retail traders are not fully invested in the stock market.

Remember nothing goes straight up or straight down so correction along the way are good for the market.

Best Regards,

Daytrader21