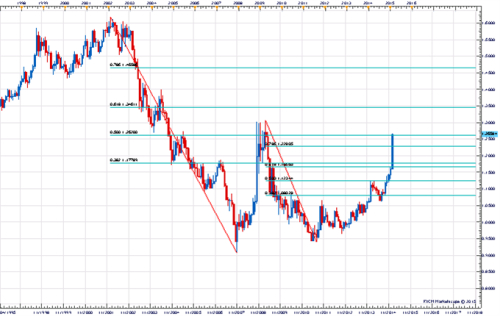

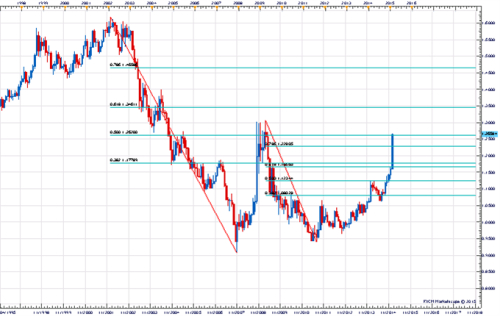

USD/CAD traded at its highest level since April of 2009 earlier today. To say the advance over the past few weeks has been impressive is probably a bit of an understatement as the pair has overcome a multitude of key long-term Fibonacci levels this past month including the 61.8% and 78.6% retracements of the 2009-2011 decline and the 38.2% and 50% retracements of the 2001-2007 decline. Overcoming just one of these levels would be an important technical development, but breaching all four in a matter of weeks is almost unprecedented. Not surprisingly sentiment towards the CAD has collapsed during this time with the DSI (Daily Sentiment Index) now at levels of extreme pessimism on every timeframe out to three weeks. From a contrarian perspective this lopsided sentiment is a cause for concern and the sentiment profile is now actually very similar to the one in JPY heading into December. We think like in yen there is a strong chance this extreme sentiment situation will lead to a decent USD/CAD correction in the near future, but we will need to see price action begin to confirm this thinking before actually positioning against this near parabolic uptrend.