Final revision to Japanese Q1 GDP was released overnight and it was a pleasant surprise to the upside with the Capital Expenditure also posting a big gain.

GDP (YoY): 3.9% vs. 2.7% expected, 2.4% previous

GDP (QoQ): 1.0% vs. 0.7% expected, 0.6% previous

GDP Capital Expenditure (QoQ): 2.7% vs. 2.3% expected, 0.4% previous

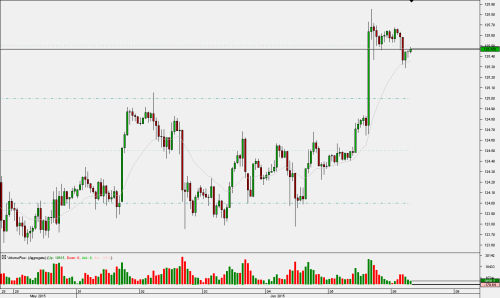

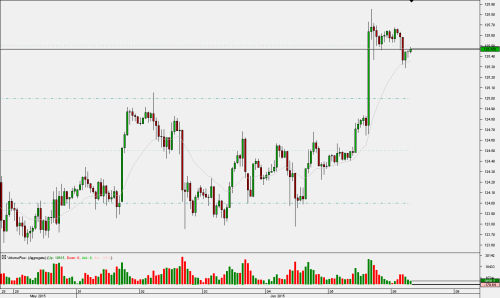

There was minor selling in USD/JPY after the release on the prospect that no additional easing will be required anytime soon. The pair found support at Daily Pivot Point (125.27). Further down, 125.00 - 125.10 may come in next (Weekly Pivot Point, 125 level). On the upside, initial resistance is to be expected in 125.75 - 126.00 band.

GDP (YoY): 3.9% vs. 2.7% expected, 2.4% previous

GDP (QoQ): 1.0% vs. 0.7% expected, 0.6% previous

GDP Capital Expenditure (QoQ): 2.7% vs. 2.3% expected, 0.4% previous

There was minor selling in USD/JPY after the release on the prospect that no additional easing will be required anytime soon. The pair found support at Daily Pivot Point (125.27). Further down, 125.00 - 125.10 may come in next (Weekly Pivot Point, 125 level). On the upside, initial resistance is to be expected in 125.75 - 126.00 band.