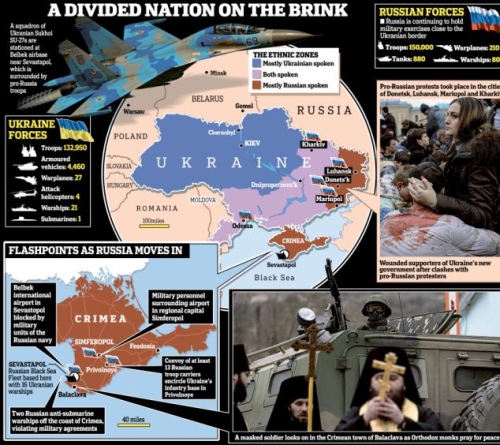

In this blog post I'm going to reproduce a small part of my in depth analysis over Ukraine crisis and what it means to the market. The whole analysis should be published in form of an article during this week, right now my article is waiting for approval, but meanwhile we can look at what an Russian invasion in Ukraine means to the Gold market

In this blog post I'm going to reproduce a small part of my in depth analysis over Ukraine crisis and what it means to the market. The whole analysis should be published in form of an article during this week, right now my article is waiting for approval, but meanwhile we can look at what an Russian invasion in Ukraine means to the Gold market

In this paragraph we're going to take an inquisitive look over the gold market and the relationship with war. Last month I've made a remark that recent developments in Ukraine and the possibility to see Russian intervention can be a catalyst for the gold to spike even higher. And at the same time we will see the dollar rallying with gold, which is unusual as they usually move in opposite directions, but with the safe haven status of dollar triggered this can be possible.

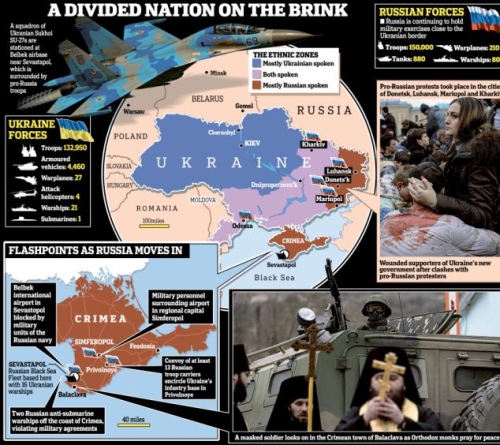

History can be our guide in forecasting futures trends in gold market as well, and I want to bring to your attention how one event can cause two opposite results: One the one hand we have the Russia invasion of Georgia, 8th August 2008, after the South Ossetia attack gold went down -12.47%, and on the other hand we have Russia invasion of Afghanistan 24 December 1979, Gold spikes up to record level almost doubling in value (see Figure 1). Now the question is why on the same event risk we had to opposite reactions, the answer is you must understand the cycle we're in.

1979 Russia invasion of Afghanistan(1980 Moscow Olympics Games) Gold doubled in price- 2014 Russia invasion of Ukraine(2014 Sochi Olympics Games) Gold, how high?

For more reference here are is my blog post about Gold market: Gold Outlook and here is the blog post I've made about Ukraine and my predictions about how things are going to unfold, keep in mind I've made this prediction more than 2 weeks ago before any Russia intervention: Olympics and Stock Market Correlation. Cycle of War

Best Regards,

Daytrader21.

In this blog post I'm going to reproduce a small part of my in depth analysis over Ukraine crisis and what it means to the market. The whole analysis should be published in form of an article during this week, right now my article is waiting for approval, but meanwhile we can look at what an Russian invasion in Ukraine means to the Gold market

In this blog post I'm going to reproduce a small part of my in depth analysis over Ukraine crisis and what it means to the market. The whole analysis should be published in form of an article during this week, right now my article is waiting for approval, but meanwhile we can look at what an Russian invasion in Ukraine means to the Gold market - Gold and War

In this paragraph we're going to take an inquisitive look over the gold market and the relationship with war. Last month I've made a remark that recent developments in Ukraine and the possibility to see Russian intervention can be a catalyst for the gold to spike even higher. And at the same time we will see the dollar rallying with gold, which is unusual as they usually move in opposite directions, but with the safe haven status of dollar triggered this can be possible.

History can be our guide in forecasting futures trends in gold market as well, and I want to bring to your attention how one event can cause two opposite results: One the one hand we have the Russia invasion of Georgia, 8th August 2008, after the South Ossetia attack gold went down -12.47%, and on the other hand we have Russia invasion of Afghanistan 24 December 1979, Gold spikes up to record level almost doubling in value (see Figure 1). Now the question is why on the same event risk we had to opposite reactions, the answer is you must understand the cycle we're in.

1979 Russia invasion of Afghanistan(1980 Moscow Olympics Games) Gold doubled in price- 2014 Russia invasion of Ukraine(2014 Sochi Olympics Games) Gold, how high?

- Figure 4. Russian invasion of Georgia, Gold down -12,47%,Russia invasion of Afghanistan, Gold doubled in price.

For more reference here are is my blog post about Gold market: Gold Outlook and here is the blog post I've made about Ukraine and my predictions about how things are going to unfold, keep in mind I've made this prediction more than 2 weeks ago before any Russia intervention: Olympics and Stock Market Correlation. Cycle of War

Best Regards,

Daytrader21.