I know is kind of long time since my last blog post, but the only reason why I've stop blogging was mainly because I was busy and secondly because I don't have any chance to come back in top 10. In today blog post I want to take the time and have a look into recent NZ dollar price movement.

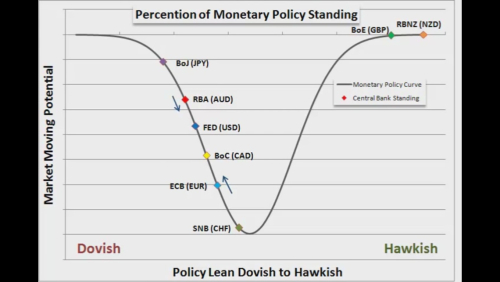

When it comes to the monetary policy RBNZ is the most hawkish Central Bank among developed economies(see Figure 1) and this is certainly reflected in recent price movement after 2 consecutive raise in interest rates. This can be a game changer for NZ dollar as in current environment where investor are chasing yield thus higher return on their investment, so NZD/USD can be a strong candidate for the carry trading strategies. A carry trade is when you buy a high interest currency against a low interest currency. So it make sens to go long NZD/USD as your broker will pay you the interest difference between the two currencies

Figure 1. Perception of Monetary policy Standing.

Although Fed is moving away from his easing cycle US interest rates will not raise as fast as per investor expectation despite Yellen's "6 months rhetoric" to raise rate after QE ends, I only see this happening in the 4th quarter of 2015 or first quarter of 2016. It may be the case that the market has already price in this 2 consecutive raise in interest rates but the only concern is that we're still below the rates we have seen before subprime crisis, so relative to that we're still very low, so there is a question on how much will it accomplish on this front of carry trading. Also RBNZ is doing a great job in communicating his market policy and making the exchange rate less volatile. But if more rates raise will follow don't be surprise to see NZD/USD breaking to new all time highs.Don't forget today we have another big risk event as we're waiting for Mario's speech, so keep an eye on that as well

Best Regards,

Daytrader21.