If Greece chooses not to deal with the debts, we would have different problems according to the agency, as the European Financial Stability Facility (EFSF) despite financed by issuing bonds, these are ultimately guaranteed (and just in case you can not afford the payments by new bond issues). the budget of the European Union and member states guarantees. This, added to the 50,000 million provided directly by European governments, it would directly affect the member states of the European Union.

In the case of the ECB, the situation is somewhat more complex. Failure to receive back 25,000 million, would cause a hole in its capital base that normally should be remedied by a capital increase, which would be borne by the governments they represent. However, while a regulated entity could never continue operating in case of negative capital base -

In current terms, and as you say some financial analysts, it should be paid 50,000 million, unconditionally, a young politician whose ideal is that everyone has access to the same amount of wealth as the ideal state is not one in which everyone has access to the same amount of wealth, but in which each receives proportion to their contribution to the overall wealth. Without this, it would be difficult to progress.

postscript.

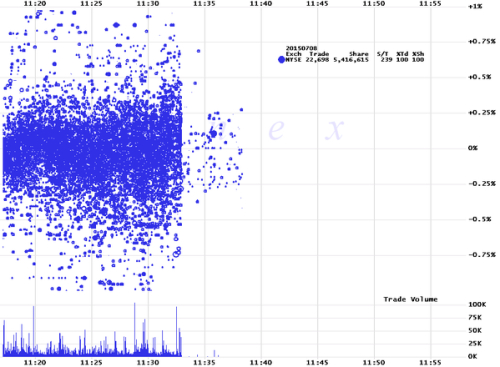

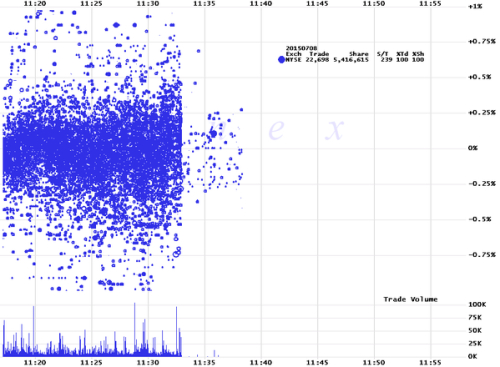

Today was suspended the NYSE by technical problems11:32:57 - trades from NYSE drop sharply, sputter a few minutes, then nothing. Each dot a NYSE trade.

In the case of the ECB, the situation is somewhat more complex. Failure to receive back 25,000 million, would cause a hole in its capital base that normally should be remedied by a capital increase, which would be borne by the governments they represent. However, while a regulated entity could never continue operating in case of negative capital base -

In current terms, and as you say some financial analysts, it should be paid 50,000 million, unconditionally, a young politician whose ideal is that everyone has access to the same amount of wealth as the ideal state is not one in which everyone has access to the same amount of wealth, but in which each receives proportion to their contribution to the overall wealth. Without this, it would be difficult to progress.

postscript.

Today was suspended the NYSE by technical problems11:32:57 - trades from NYSE drop sharply, sputter a few minutes, then nothing. Each dot a NYSE trade.