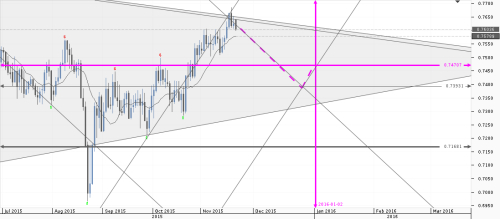

INDICATORS : RSI, Volatility, Volume, HMM KEY PRICE LEVELS : 0.68918 0.71681 0.74707 0.75995 0.78810 0.8003

Weekly CHARTS PATTERN : resistance line , W1 Chart.

Weekly VISION

CAD/CHF is moving in a downtrend triangle dynamics . The chart analysis bearish trend can be supported by the Hidden Markov Models Analysis, the RSI momentum indicator. Retail Sales at -0.5 % are coherent with a bearish regime.

The 0.75995 area is evaluated as resistance area.

Daily VISION

The D1 scale indicates that CAD/CHF is in a slightly bullish regime. The chart analysis indicates 0.74707 as a possible key level price. This resistance area at 0.75995 could also lead to a Canadian dollar recovery . HMM in this scale statistically register a bearish retracement but the RSI and the chart analysis support a slightly regime.

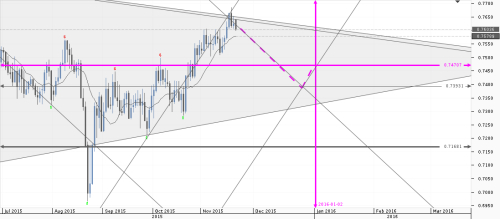

Weekly CHARTS PATTERN : resistance line , W1 Chart.

Weekly VISION

CAD/CHF is moving in a downtrend triangle dynamics . The chart analysis bearish trend can be supported by the Hidden Markov Models Analysis, the RSI momentum indicator. Retail Sales at -0.5 % are coherent with a bearish regime.

The 0.75995 area is evaluated as resistance area.

Daily VISION

The D1 scale indicates that CAD/CHF is in a slightly bullish regime. The chart analysis indicates 0.74707 as a possible key level price. This resistance area at 0.75995 could also lead to a Canadian dollar recovery . HMM in this scale statistically register a bearish retracement but the RSI and the chart analysis support a slightly regime.