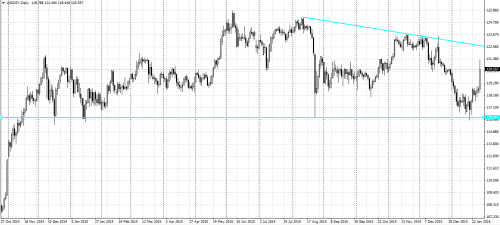

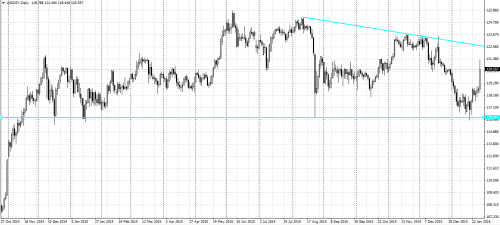

Today's BoJ announcement deviated from most analysts expectations. BoJ kept the same amount of assets purchases but slashed the interest rate to negative. Will JPY follow the same depreciation route as it did already twice after quantitative easing introductions? It might definitely fall from overbought territories. However, the current gloomy mood in the markets calls for JPY as a safe haven currency. Similar situation persists in the market with Euro. It's a nice question to the participants of the strategy contest to define the JPY path in the nearest future. My humble opinion is that JPY with today's spike after the news has set the intermediate low and should strengthen or trade in the range until risk appetite and investor confidance returns to the market. On the contrary, there is some room for further weakening of JPY on the example of USDJPY attached. The pair is trading in the triangle. USDJPY can go to the upper trenline of the triangle and reverse. As a trade strategy I would urge not to fall into a trap of common forex expectations that lowerring the rate will lead to the currency depreciation. USDJPY is a slowmoving pair in absence of the news. I expect it to fall asleep into the range after today's price action is over.