Greetings Everyone.

Here are my analysis on USD/CAD pair on the basis of current scenario on Daily, 4H and 1H Time frame charts.

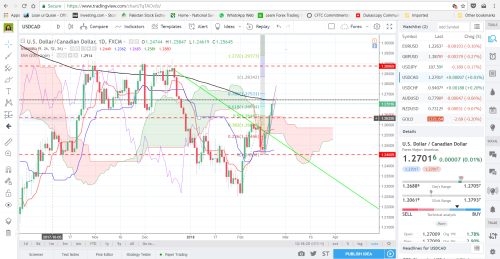

Daily Charts

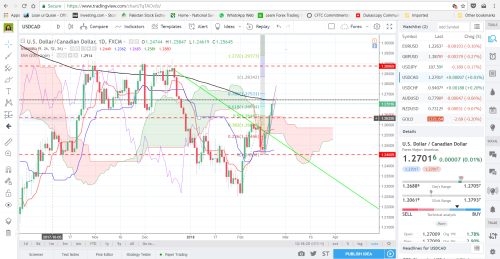

4H TF Chart

1H TF Chart

*The position is more clear on 4H and 1H time frames.. The price is trading within a 1H TF channel.*The price is above the Tenkan Sen (Red Line) and Kijun Sen (Blue Line) and Chikou Span (Purple line) is also trading well above the price.

Conclusion:

So the overall trend is Bullish as per my analysis.

**Disclaimer:__**

Please note that no one can predict future. What I have posted here is just my own opinion/analysis (which might wrong). So always take precautions before taking any Buy or Sell order to secure your Capital.Always use stop loss and trailing stop to save your capital as well as profit.

Here are my analysis on USD/CAD pair on the basis of current scenario on Daily, 4H and 1H Time frame charts.

Daily Charts

- On the Daily chart the structure of the pair showing HH and HL, which means the start of a Bullish Trend.

- USD/CAD has showed a recent Pullback and it is now trading in the 3rd Impulsive Wave.

- There is a Kumo Breakout and price is trading above the Kumo. However, the Kijun Sen, Tenken Sen are almost Flat and the price is below the 200 EMA.

- The current price is just touching the 61.8% level of Fib ratio.

- The price has broken the 4H TF trend line (Green).as well as the Resistance Area (Red dotted lines) around 1.26332.

- On the daily chart, there is a major resistance area at 1.28869 just below the Fib level of 1.272% (1.29373).

- One can get almost 150+ pips, if he/she enters into Long Trade above 200 EMA (1.2721) and take profit below the major resistance level of 1.28869.

4H TF Chart

1H TF Chart

*The position is more clear on 4H and 1H time frames.. The price is trading within a 1H TF channel.*The price is above the Tenkan Sen (Red Line) and Kijun Sen (Blue Line) and Chikou Span (Purple line) is also trading well above the price.

Conclusion:

So the overall trend is Bullish as per my analysis.

**Disclaimer:__**

Please note that no one can predict future. What I have posted here is just my own opinion/analysis (which might wrong). So always take precautions before taking any Buy or Sell order to secure your Capital.Always use stop loss and trailing stop to save your capital as well as profit.