Today is ECB turn to hit the front stage, after RBA, BOE and yesterday BOC interest rate decision. Every now and than ECB meets outside of Frankfurt and today's meeting will be held in Cyprus. The market consensus is that ECB isn't going to make any monetary policy changes, however ECB more likely is going to release the execution details of the QE programme.

Today is ECB turn to hit the front stage, after RBA, BOE and yesterday BOC interest rate decision. Every now and than ECB meets outside of Frankfurt and today's meeting will be held in Cyprus. The market consensus is that ECB isn't going to make any monetary policy changes, however ECB more likely is going to release the execution details of the QE programme.There are already some rumors in the market that gives highs odds that: "ECB may start buying securities as part of its QE programme on 9 March".

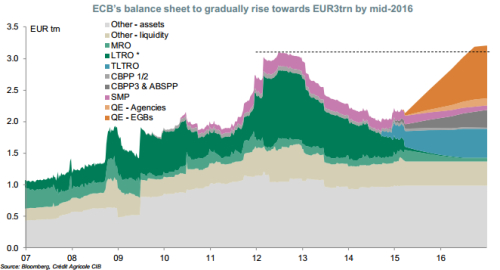

The other 2 key elements of tomorrow's meeting are the inflation and growth forecasts. By some analysts ECB’s balance sheet is forecast to gradually raise to 2.7T by the end of 2015 and 3.3T by the end of 2016 (see Figure 1)

Figure 1. ECB Balance Sheet Forecast

- EUR/USD Market Reaction

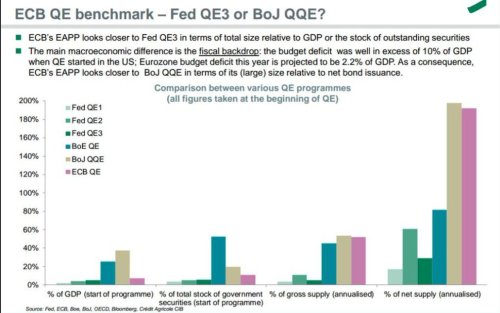

Going into the meeting we should expect the downward pressure on the euro to remain intact. It is very important to notice the differences in magnitude and size of QE programee across major Central Banks (see Figure 2), as this will be key in understanding why certain currency pairs, like EUR/JPY will not move to the downside as much as you would think, of course this holds true as long as BOJ maintain current QQE programme size as well.

Figure 2.Comparison between various QE programme.

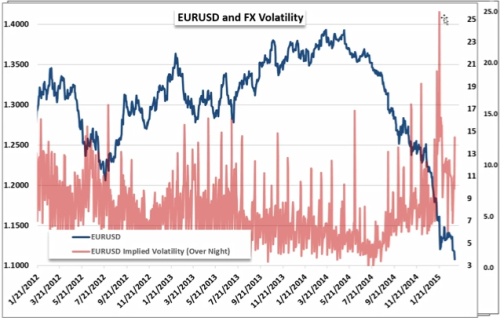

The details of the QE programme will be crucial for the EUR/USD reaction to this ECB meeting and as such we can see a jump in volatility and more likely than not with this type of news the market may get confused at first by the news flow that will hit the market an as such we can experience a big whipsaw. Even thought short term reaction can even generate a minor retracement as the EUR/USD implied volatility may suggest (see Figure 3) long term trend is still to the downside. Historically speaking the implied volatility may not be as high as in other cases and as such it can continue going higher in which case is just a false signal. Higher implied volatility only suggest investor fear which is another indicator to be considered when approaching the market.

Figure 3. EUR/USD Daily Chart and EUR/USD Implied Volatility

Best Regards,

Daytrader21