Today is a big day in term of risk events as we have the job report. The labor market seems to be picking up as the recent bad weather effect on the market is fading away and the job market has start picking up.

Today is a big day in term of risk events as we have the job report. The labor market seems to be picking up as the recent bad weather effect on the market is fading away and the job market has start picking up.Market participants will pay close attention to this figures especially after Yellen has introduced the new qualitative forward guidance and employment data has become an indicator of economic growth.

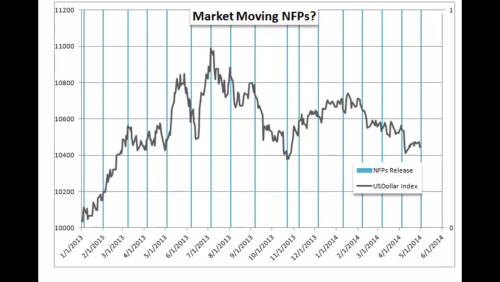

This NFP report has a great potential of being a big market moving after later this week we missed the GDP figures which came worse than expected at only 0.1% for the first quarter of 2014 and which has put pressure on the back of US dollar. In Figure 1 you can see the US dollar performance on day of NFP going back to January 2013 and what strikes the most is the fact that although in the last months the labor market improve we can see that the dollar performance was poorly.

Figure 1. Market moving NFP. USDollar Index.

Market expectation for today's release are for further increase in job creation, and the market consensus is for another 210k new jobs in the last month, previously we had 192K. Also the unemployment rate is expected to drop to 6.6%, previously 6.7%. Any improvements in the labor market can be a signal for the interest rates raise expectation to raise earlier than expected thus making US yields raise, but recently we could see a decoupling between yields and US dollar movement, which can further fuel dollar weakness.

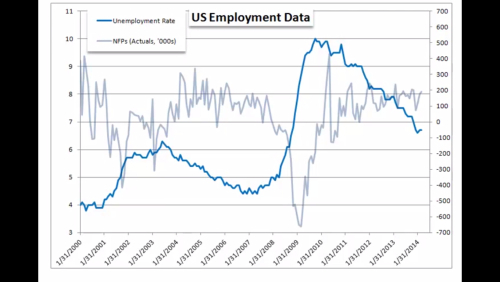

Figure 2. US Employment data.

In Figure 2 we can have a look at the bigger picture on US employment data which is self explanatory as it can bee seen that the unemployment rate is on track to achieve FED previous target of 6.5% which is no longer a mandate as we're now in a new type of qualitative forward guidance.

Best Regards,

Daytrader21