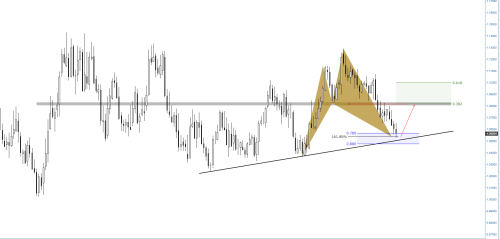

The pattern is printed at 161.8% fib extension, also known as a fib reversal zone, and with targets by default positioned at 38%, 50% and 61.8% fib retracement.

The AUDNZD may be forming a down channel which we pivoted off the bottom today. We also hi the confluence of 161% extensions and bounced with a divergent daily RSI, the risk could be higher if the 1.0600 level is taken back.

AUD and NZD both strongly affected by commodities and the Chinese economy. Bullish macro bias: Improving AUD data and the RBNZ's reluctance to allow the Kiwi to appreciate should drive the pair higher, but US-China trade war worries are keeping a lid on it for now.

Another black candle on the weekly resumes the move lower.

The AUDNZD has broken below the 1.082 key level and that is a bearish development.

Harmonics: Bullish harmonic pattern printed at major structure trend-line acting as support.