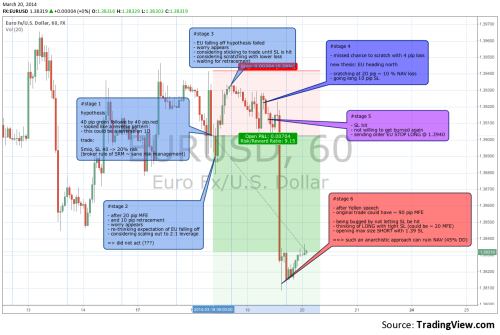

what could've been a good trade failed. Image below describes how it happened.

# stage 1

EU had 40 pip run-up followed by 40 pip fall, which led to this

hypothesis:

- EU will fall off

- 40 pip green followed by 40 pip red -> a reversal pattern

- we could see reverse on 1D

trade:

- EU 5mio short, SL 40 -> 20% risk

=> expected EU fall out, went all in max size translating to 20% risk (braking rule of sane risk management, aka SRM)

# stage 2

- after 20 pip MFE

- and 10 pip retracement on 1H candle

- worry appears

- re-thinking expectation of EU falling off

- considering scaling out to 2:1 leveraged size

=> did not act (no clues why???)

# stage 3

- EU falling off hypothesis seemed to fail at this point

- worry appears

-- let the SL be hit

-- or scratching the trade at a lower loss

- decided to scratch, but wait for a retracement

# stage 4

- missed chance to scratch with 4 pip loss

new thesis: EU heading north (seen it in some analysis ... LOL )

- scratching at 20 pip loss ~ 10% NAV

- going long with 10 pip SL

# stage 5

- stop loss being hit

- not willing to go in again and get burned

- sending an order EU LONG STOP @ 1.3940

# stage 6

- EU falling 90 pip after Yellen speech

- STOP order could not trigger

- original trade could have had ~ 90 pip MFE

- feeling pitty

- option to get SL being hit appears to be the better one in this case

- feeling anger

-- thinking of going long with a tight SL (expecting a retracement, ~20 pip MFE)

-- opening SHORT instead with 1.39 SL

==> such an anarchistic approach can ruin NAV with 45% DD

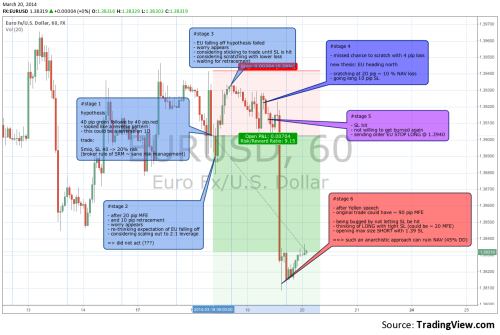

# stage 1

EU had 40 pip run-up followed by 40 pip fall, which led to this

hypothesis:

- EU will fall off

- 40 pip green followed by 40 pip red -> a reversal pattern

- we could see reverse on 1D

trade:

- EU 5mio short, SL 40 -> 20% risk

=> expected EU fall out, went all in max size translating to 20% risk (braking rule of sane risk management, aka SRM)

# stage 2

- after 20 pip MFE

- and 10 pip retracement on 1H candle

- worry appears

- re-thinking expectation of EU falling off

- considering scaling out to 2:1 leveraged size

=> did not act (no clues why???)

# stage 3

- EU falling off hypothesis seemed to fail at this point

- worry appears

-- let the SL be hit

-- or scratching the trade at a lower loss

- decided to scratch, but wait for a retracement

# stage 4

- missed chance to scratch with 4 pip loss

new thesis: EU heading north (seen it in some analysis ... LOL )

- scratching at 20 pip loss ~ 10% NAV

- going long with 10 pip SL

# stage 5

- stop loss being hit

- not willing to go in again and get burned

- sending an order EU LONG STOP @ 1.3940

# stage 6

- EU falling 90 pip after Yellen speech

- STOP order could not trigger

- original trade could have had ~ 90 pip MFE

- feeling pitty

- option to get SL being hit appears to be the better one in this case

- feeling anger

-- thinking of going long with a tight SL (expecting a retracement, ~20 pip MFE)

-- opening SHORT instead with 1.39 SL

==> such an anarchistic approach can ruin NAV with 45% DD