Beside BOE minutes and interest rates decision there is nothing else on the news wire that can be a market mover except the FOMC minutes. The only thing that matters for investors is to look for more clues as to when the FED will start hiking interest rates.

Beside BOE minutes and interest rates decision there is nothing else on the news wire that can be a market mover except the FOMC minutes. The only thing that matters for investors is to look for more clues as to when the FED will start hiking interest rates.When it comes to the bond-buying program Fed Chair Yellen has been very clear that the purchases will end in October so traders will look to this FOMC minutes to provide clues for rate rise timing. When it comes to timing next hike in rates Yellen has been very dovish over the last few meetings and she said that rates will stay low for a "considerable time" after the bond purchases end in October. But inside the FED there are more voices and the hawks may warn that rates can raise sooner because of the inflationary pressures.

Almost every analysts projects the first rate hike for the mid-2015 and also the minutes can reveal that Fed members are moving towards rates hike faster than expected, because relative to previous months many FED members are more optimistic about the US economic recovery.

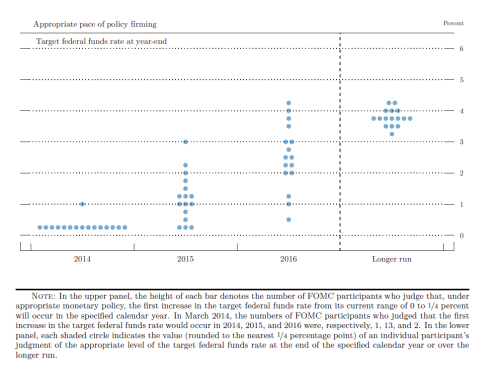

Figure 1. Fed "Dot Chart" (Source Federal Reserve Bank)

On this one we'll have to keep an eye on the Federal Reserve's "dot chart" which shows where Fed officials believe interest rates will be over the next three years, as well as over the long term (see Figure 1). So far only one member is calling for a hike rate this year where the majority see a rate hike more appropriate for next year. What I'm expecting for this meeting is for Yellen to play his dovish cards and pause current dollar bull run.

Best Regards,

Daytrader21