First major event risk of the week is set to be RBA interest rate decision. Last time I was correctly predicting a no move from RBZ, basing my decision on the inter banking futures rates which have been predicted 24 of the last 25 RBA decisions correctly. The OIS market is pricing in an 80% chance of a cut in April.

First major event risk of the week is set to be RBA interest rate decision. Last time I was correctly predicting a no move from RBZ, basing my decision on the inter banking futures rates which have been predicted 24 of the last 25 RBA decisions correctly. The OIS market is pricing in an 80% chance of a cut in April.You can read more about it here: RBA Keeps Rates on Hold

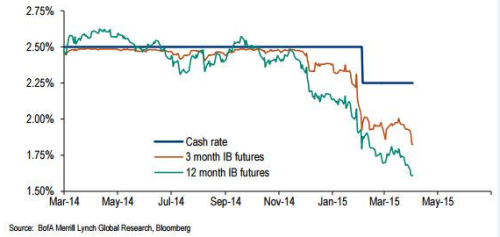

When you have an indicator with such a high level of accuracy it's undoubtedly mistakenly to ignore it. Both the, aussie 90 day bill and 12 month bill are pricing in a rate cut quite aggressively (see Figure 1)

In favor of a rate cut comes also the latest NFP figures which have come worse than expected and definitely are pushing the probabilities in favour of a rate cut.

Another factor supporting a rate cut is the recent plunge in iron ore price which are trading at $49/T and had a severe impact on Australia economy cutting in March alone the exports revenue by $8B, which translate into 5% of GDP.

Figure 1. Aussie 3-12 months Bills vs Cash rate

Now that we know how the odds are skewed, it's safe to put our bets, as long as you understand all the factors that supports my reasoning and you have a plan. In case the plan doesn't work you use SL to protect yourself, that's what stops are for.

Best Regards,

Daytrader21