Probably today is the most important day before the year end. And like the last meeting from September there are growing bets that the Fed will start cutting back from their QE programme and move away from his easing cycle. It seems that the most they agree with something, and here I'm speaking about the tapering, the higher the probability it will not happen.

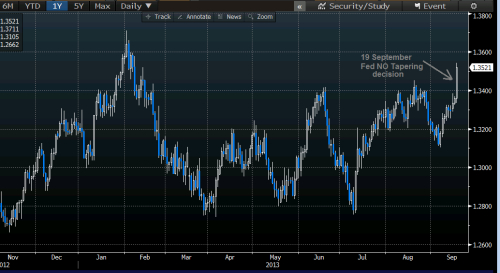

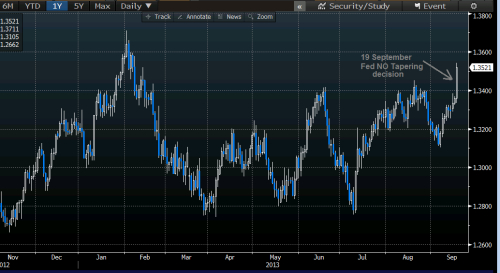

And if you think that's easy, timing when the Fed will start tapering, just think again, only recently we saw FED unexpectedly refrained from tapering at their meeting in September, taking everyone by surprise and shocking the market. Every analyst and economist was beating for a September tapering like a done deal, but the no taper decision boosted EUR/USD to levels last seen in February as the dollar sold of, at that time. If you where on the right side of the market you could have made lots of money as for example EUR/USD has jumped more than 200 pips in a matter of few hours on that news alone(see Figure 1).

During the FOMC statement traders must prepare for huge volatility, either if we have a taper or no taper decision. But as I said before my expectation for today's meeting are for a no taper decision. But the best conclusion you can draw from here is that you have to consider both sides of the market and never rule out the possibility of tapering. Always be prepare for the unexpected to happen, and just let the market to guide you.

During the FOMC statement traders must prepare for huge volatility, either if we have a taper or no taper decision. But as I said before my expectation for today's meeting are for a no taper decision. But the best conclusion you can draw from here is that you have to consider both sides of the market and never rule out the possibility of tapering. Always be prepare for the unexpected to happen, and just let the market to guide you.

If we'll have a no taper decision, which is more likely, trader's attention will shift towards Ben Bernanke's rhetoric which for sure will hint on taper expectation and probabilities for tapering to happen in the following months, or sooner than expected. Probably the market will move slowly today as every market participants will wait for FED decision before to have any positions.

Best Regards,

Daytrader21.

And if you think that's easy, timing when the Fed will start tapering, just think again, only recently we saw FED unexpectedly refrained from tapering at their meeting in September, taking everyone by surprise and shocking the market. Every analyst and economist was beating for a September tapering like a done deal, but the no taper decision boosted EUR/USD to levels last seen in February as the dollar sold of, at that time. If you where on the right side of the market you could have made lots of money as for example EUR/USD has jumped more than 200 pips in a matter of few hours on that news alone(see Figure 1).

During the FOMC statement traders must prepare for huge volatility, either if we have a taper or no taper decision. But as I said before my expectation for today's meeting are for a no taper decision. But the best conclusion you can draw from here is that you have to consider both sides of the market and never rule out the possibility of tapering. Always be prepare for the unexpected to happen, and just let the market to guide you.

During the FOMC statement traders must prepare for huge volatility, either if we have a taper or no taper decision. But as I said before my expectation for today's meeting are for a no taper decision. But the best conclusion you can draw from here is that you have to consider both sides of the market and never rule out the possibility of tapering. Always be prepare for the unexpected to happen, and just let the market to guide you.If we'll have a no taper decision, which is more likely, trader's attention will shift towards Ben Bernanke's rhetoric which for sure will hint on taper expectation and probabilities for tapering to happen in the following months, or sooner than expected. Probably the market will move slowly today as every market participants will wait for FED decision before to have any positions.

Best Regards,

Daytrader21.