New strategy :

Hold long entered at 0.9600, Target: 0.9700, Stop: 0.9545

Position : - Long at 0.9600

Target : - 0.9700

Stop : - 0.9545

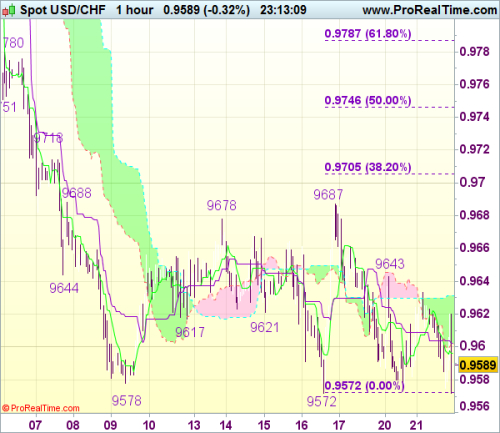

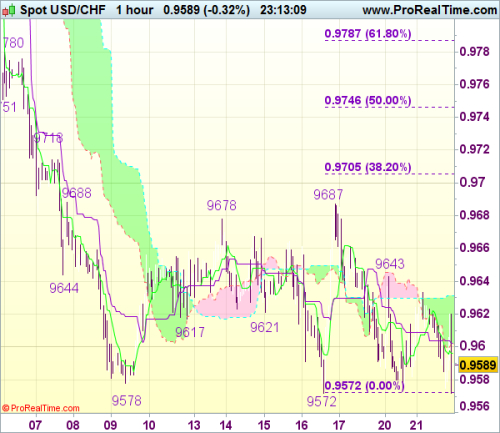

Failure to extend intra-day rebound and current retreat suggest further consolidation would be seen, however, as long as last week's low at 0.9572 holds, mild upside bias remains for another bounce, above resistance at 0.9643 would signal the retreat from 0.9687 has ended, bring another test of this level, break there would provide confirmation that a temporary low has been made, bring retracement of recent decline to 0.9705 (38.2% Fibonacci retracement of 0.9920-0.9572), then 0.9720 but reckon 0.9746-51 (50% Fibonacci retracement and previous support) would hold.

In view of this, we are holding on to our long position entered at 0.9600. Only break of said support at 0.9572 would signal recent decline has once again resumed and may extend weakness to 0.9555-58 and possibly 0.9530-33 but reckon 0.9500 would hold from here.

Hold long entered at 0.9600, Target: 0.9700, Stop: 0.9545

Position : - Long at 0.9600

Target : - 0.9700

Stop : - 0.9545

Failure to extend intra-day rebound and current retreat suggest further consolidation would be seen, however, as long as last week's low at 0.9572 holds, mild upside bias remains for another bounce, above resistance at 0.9643 would signal the retreat from 0.9687 has ended, bring another test of this level, break there would provide confirmation that a temporary low has been made, bring retracement of recent decline to 0.9705 (38.2% Fibonacci retracement of 0.9920-0.9572), then 0.9720 but reckon 0.9746-51 (50% Fibonacci retracement and previous support) would hold.

In view of this, we are holding on to our long position entered at 0.9600. Only break of said support at 0.9572 would signal recent decline has once again resumed and may extend weakness to 0.9555-58 and possibly 0.9530-33 but reckon 0.9500 would hold from here.