News Trading

February 7, 2014

US NFP (Non Farm Payroll)Employment

US NFP is the first major release of the year and we expect plenty of volatility following the

release. In the event we do get our deviation, it’s important to follow the plan as set forth below.

8:30am (NY Time) US NFEmployment Forecast 184K Previous 74K

Deviation: 70K (BUYUSD 254K / SELL USD 114K)

[b]8:30am (NY Time) US Unemployment RateForecast 6.7% Previous 6.7%[/b]

[b]The Trade Plan[/b]

Today’s NFP Employment Change release is forecasted at 184K. The Unemployment Rate is expected to remain at 6.7%. If we get a significantly lower release on the NFP (114K or worse) and slightly higher Unemployment Rate (6.7% or more), I´d be looking to SELL the USD against stronger currencies as speculation for Feds to pause tapering should dominate the market. On the other hand, if we get a

strong NFP release (254K or better) and the Unemployment Rate falls or remain at 6.7%, USD could strengthen and I would BUY USD against other weaker currencies .

If we get a conflicting release, then well wait and see how the market reacts first. If there is an overwhelming sentiment driving the market, well get plenty of opportunities for an entry if we just wait for 5 minutes after the release; you´ll get a much clearer view.

CA Employment Change

We´ll be getting the Canadian Employment Change release number today, but since the market is focused on news out of U.S. (Non Farm Payroll), this release will probably work only if it is going in the same direction as the U.S. news; at any rate, I would recommend to focus on the US release first.

8:30am (NY Time) CADEmployment Change

Actual ??? Forecast19.7K Previous -45.9K

DEVIATION: 25K (BUYCAD @ 44.7K / SELL CAD @ -5.3K)

[b]8:30am (NY TIme) CAD Unemployment Rate[/b]

Actual??? Forecast 7.1% Previous 7.2%

I´ll also pay close attention to the unemployment rate, which is expected at 7.1%. As long as this number does not conflict with the Employment Changes, we should follow the direction of the news release. If we get a conflict, such as better

Employment Changes but higher Unemployment Rate, then we´ll need to look at the context of the market before taking the trade.

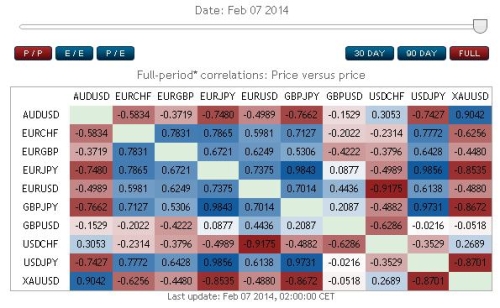

CUIRRENCY CORRELATIONS / February 7, 2014

Good Luck!